Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

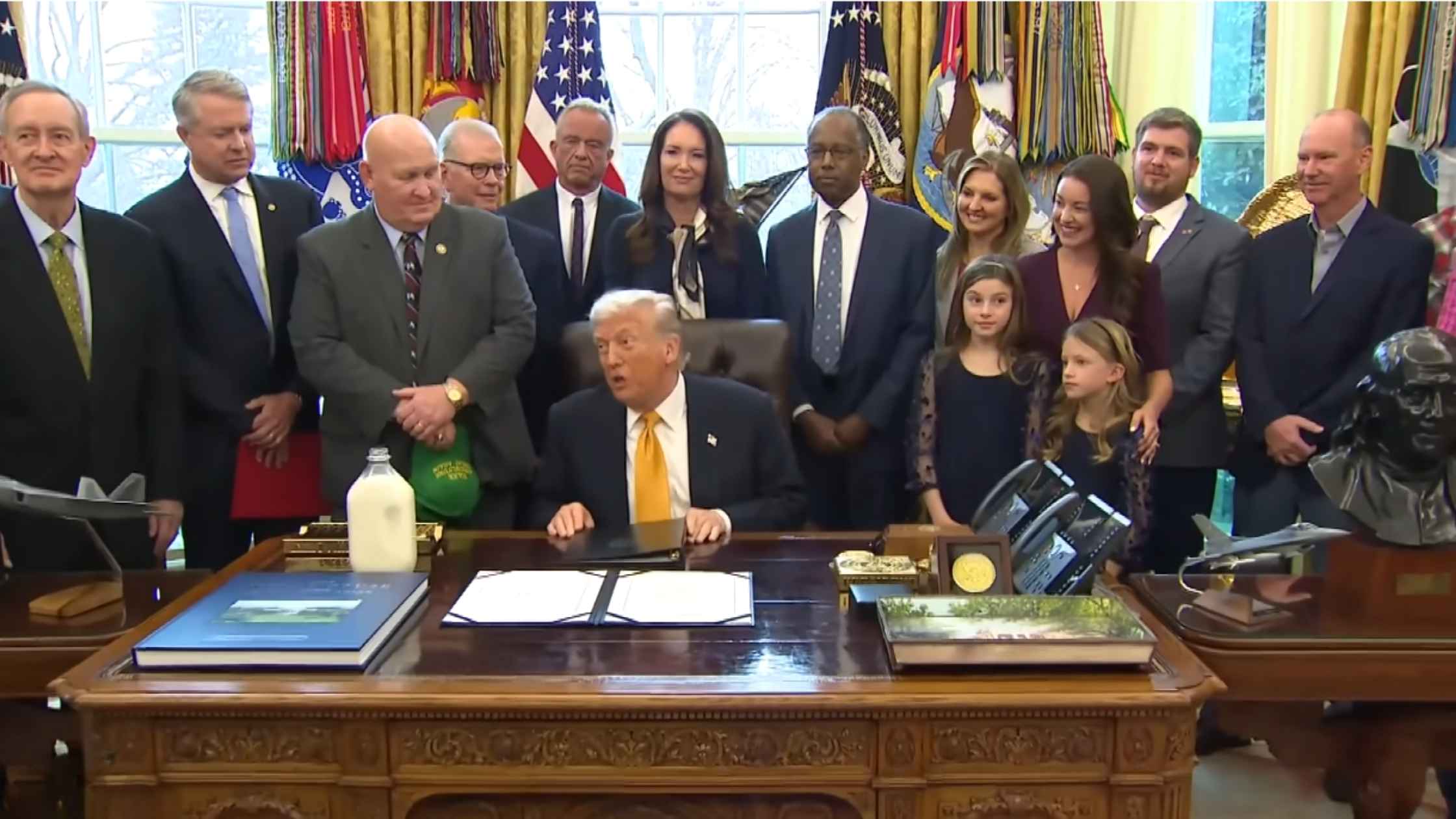

Whole Milk Executive Order

Donald Trump signs the Whole Milk for Healthy Kids Act into law. Read the transcript here.

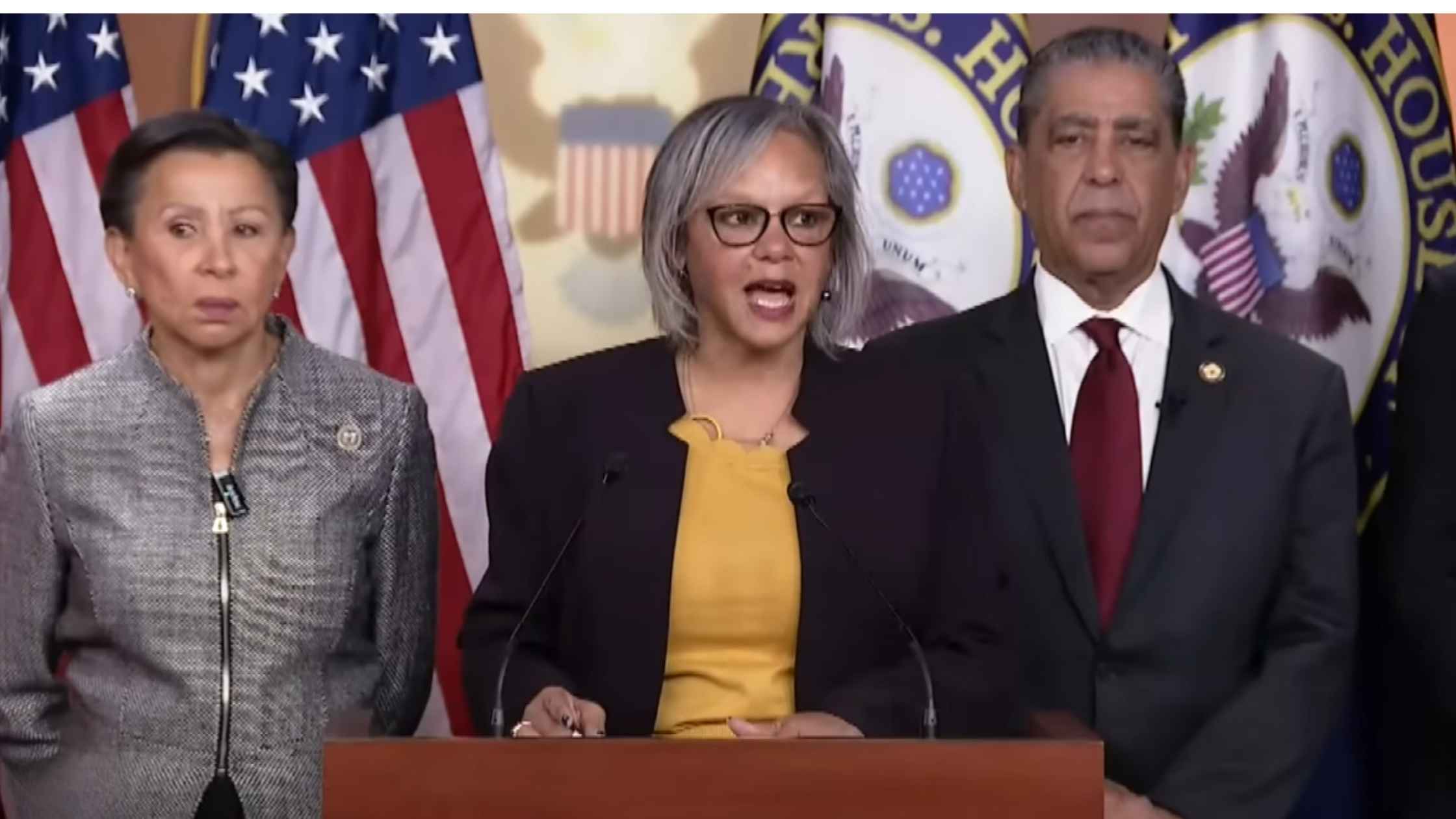

Noem Impeachment Articles

Representative Robin Kelly says she filed articles of impeachment against Kristi Noem. Read the transcript here.

Danish and Greenland Leaders Press Conference

Danish and Greenlandic delegations hold a press conference following talks with their US counterparts. Read the transcript here.

Senate Hearing on Abortion Drugs

Senate Committee on Health, Education, Labor, and Pensions hearing on Mifepristone, one of two abortion pills approved by the FDA. Read the transcript here.

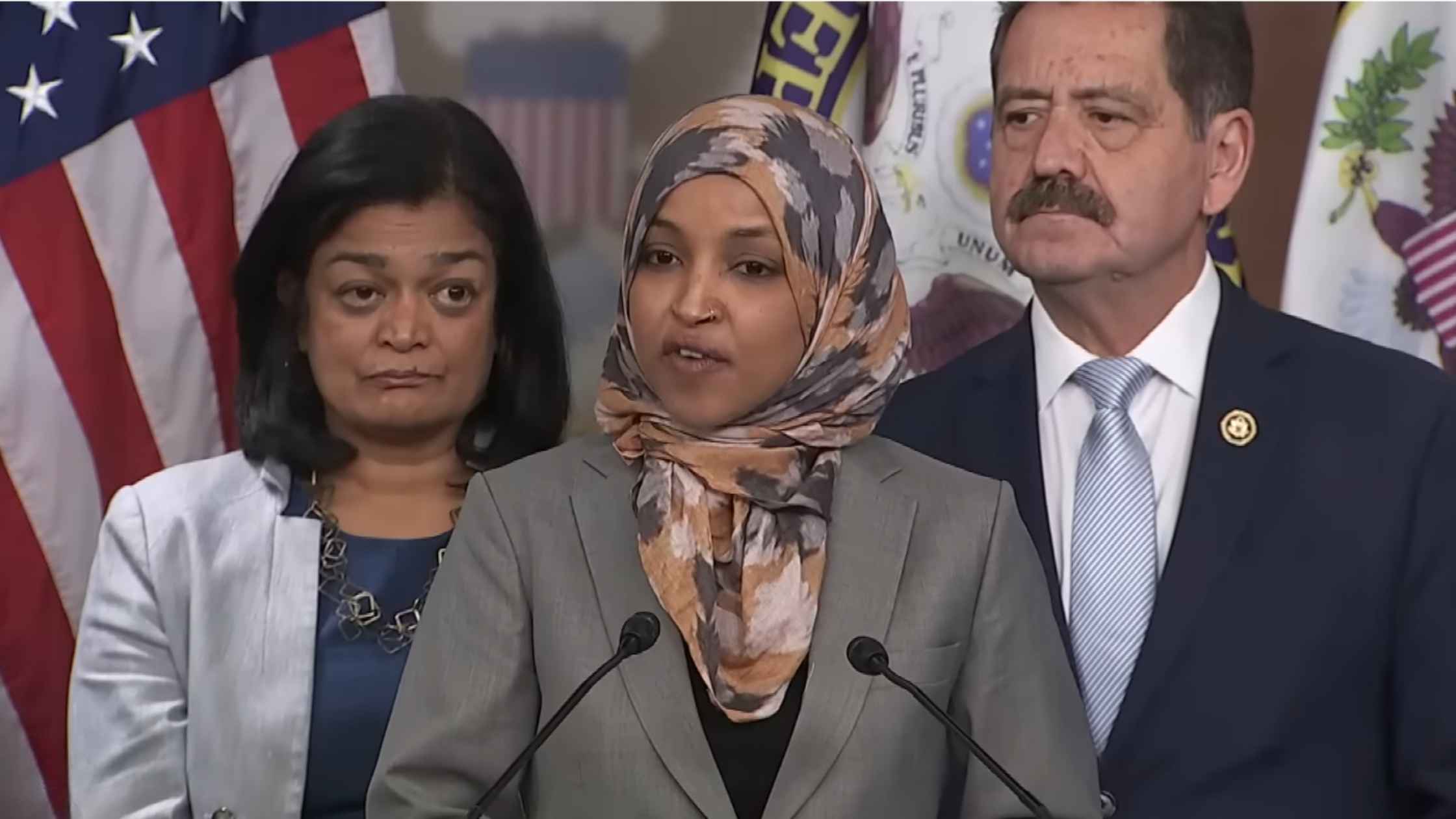

CPC speaks on DHS

Ilhan Omar and members of the Congressional Progressive Caucus hold a press conference on DHS funding and reform. Read the transcript here.

Greenland Mineral Resouce Minister Press Conference

Greenland's Mineral Resources Minister Naaja Nathanielsen speaks ahead of a meeting with JD Vance and Secretary of State Marco Rubio. Read the transcript here.

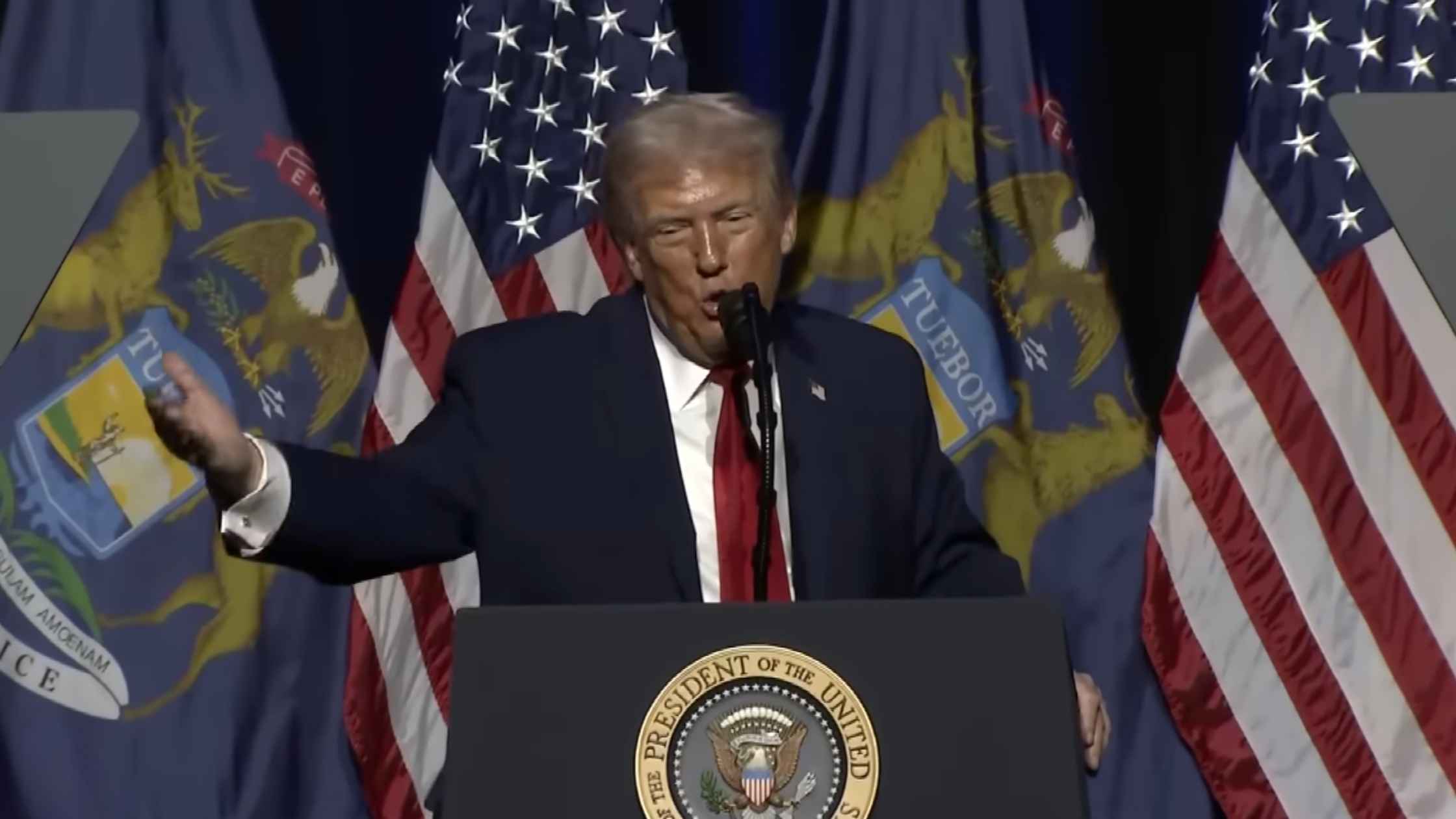

Trump at the Detroit Economic Club

Donald Trump delivers remarks at the Detroit Economic Club in Detroit, Michigan. Read the transcript here.

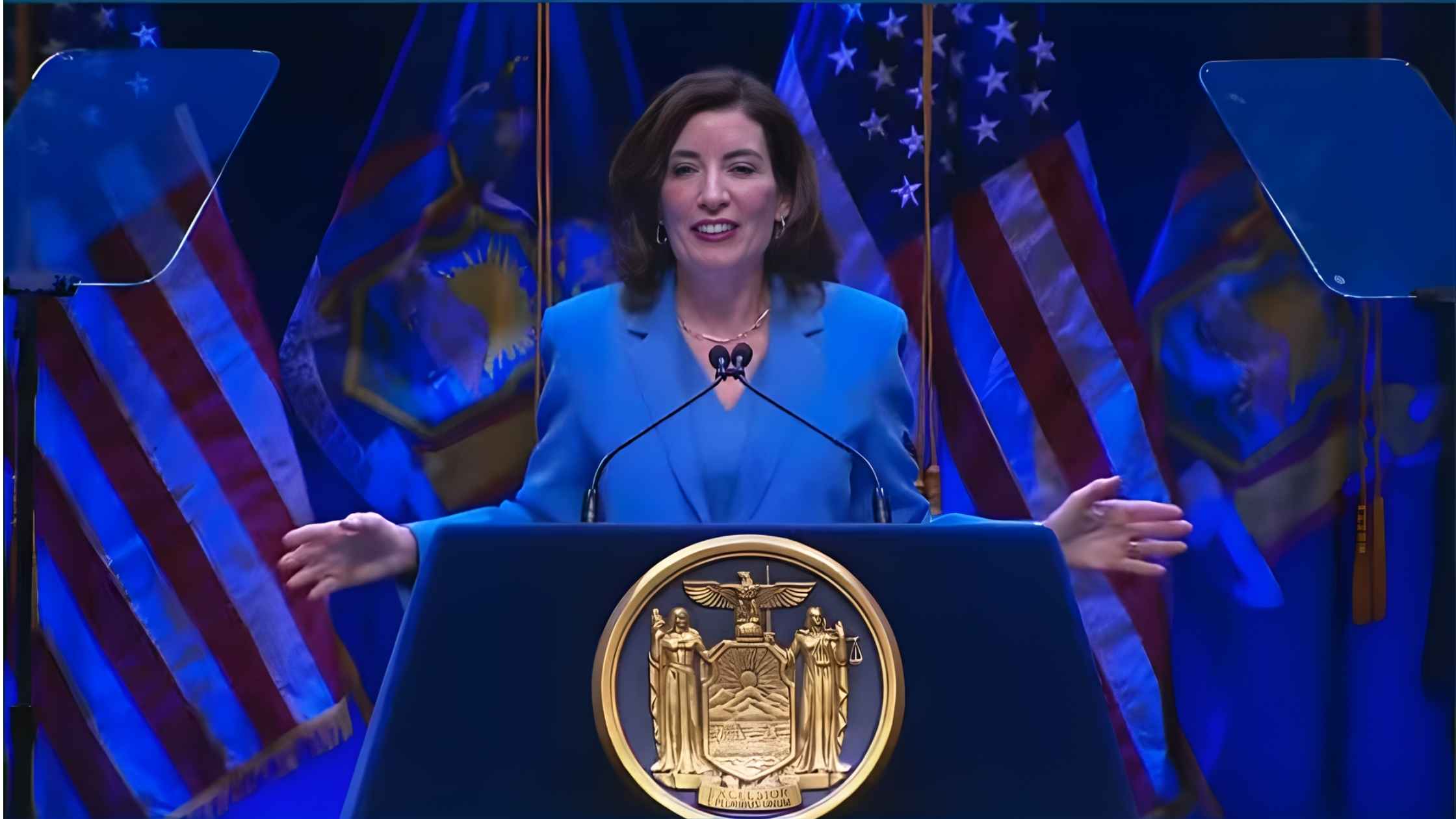

NY State of the State Address

New York Governor Kathy Hochul delivers the State of the State address on 1/13/26. Read the transcript here.

Supreme Court Hearing on Transgender Students Sports Bans

The Supreme Court hears arguments on whether states can ban transgender students from sports. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.