Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

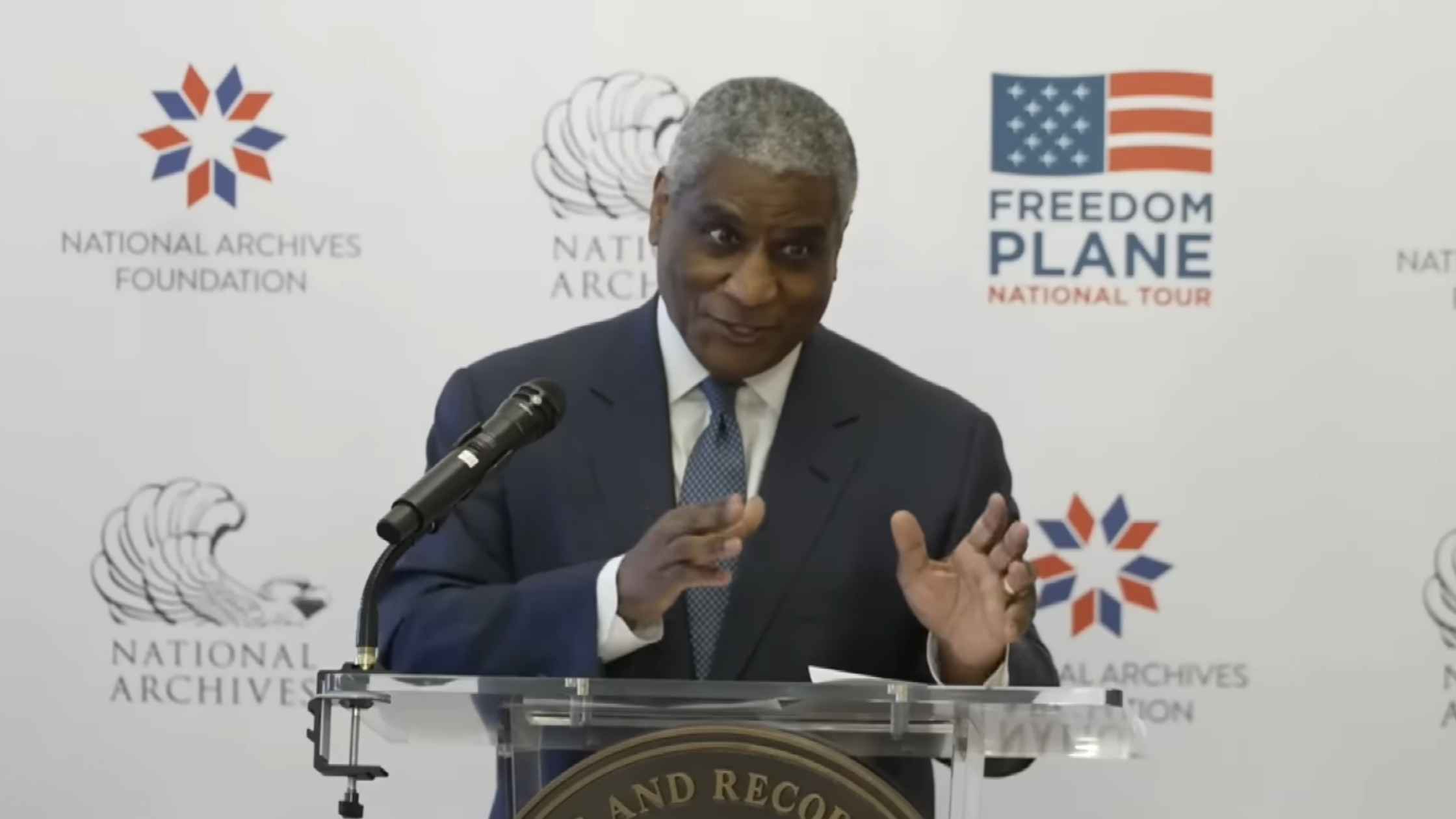

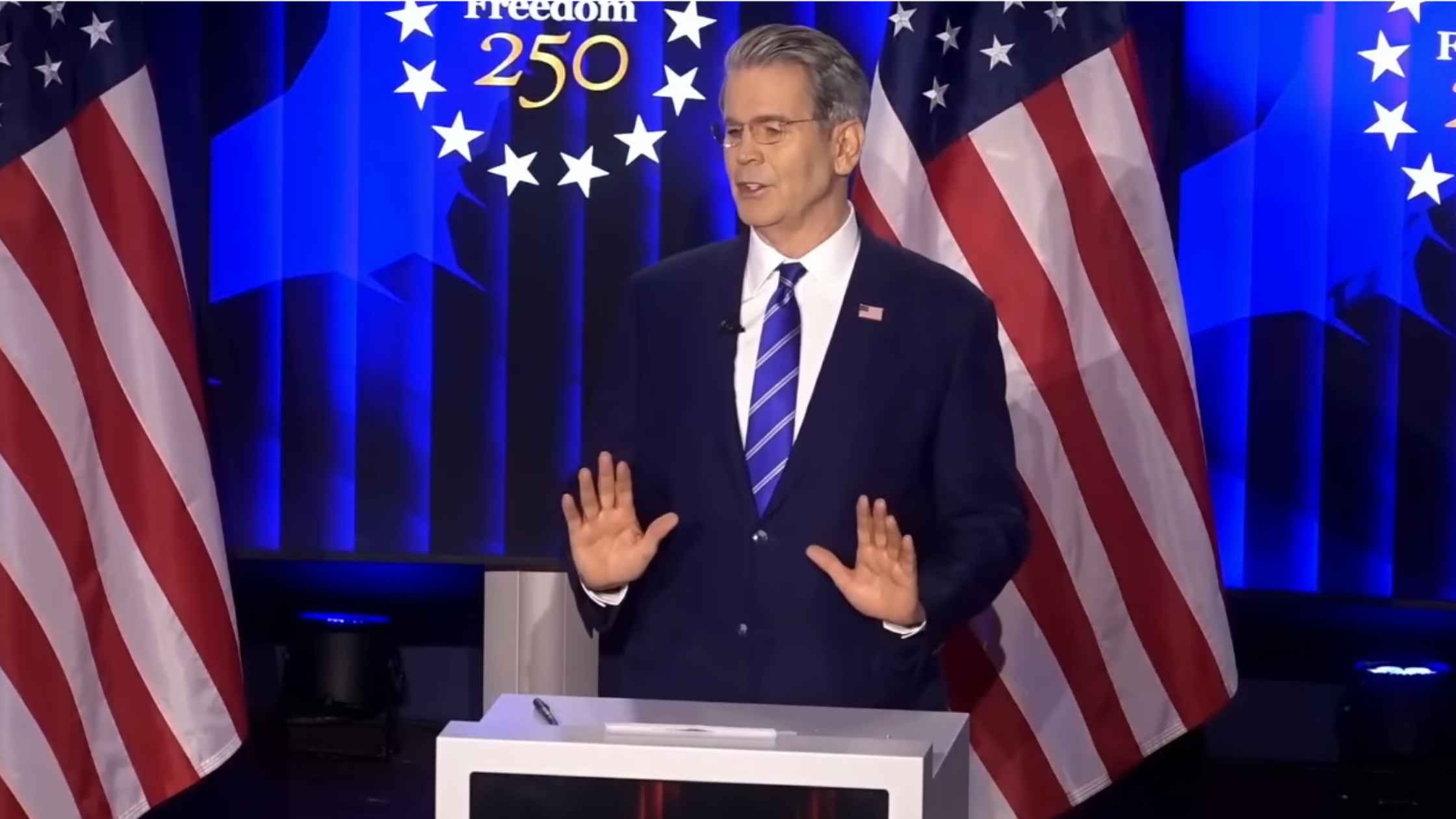

National Archives Preview

The National Archives previews an exhibition marking America's 250th anniversary. Read the transcript here.

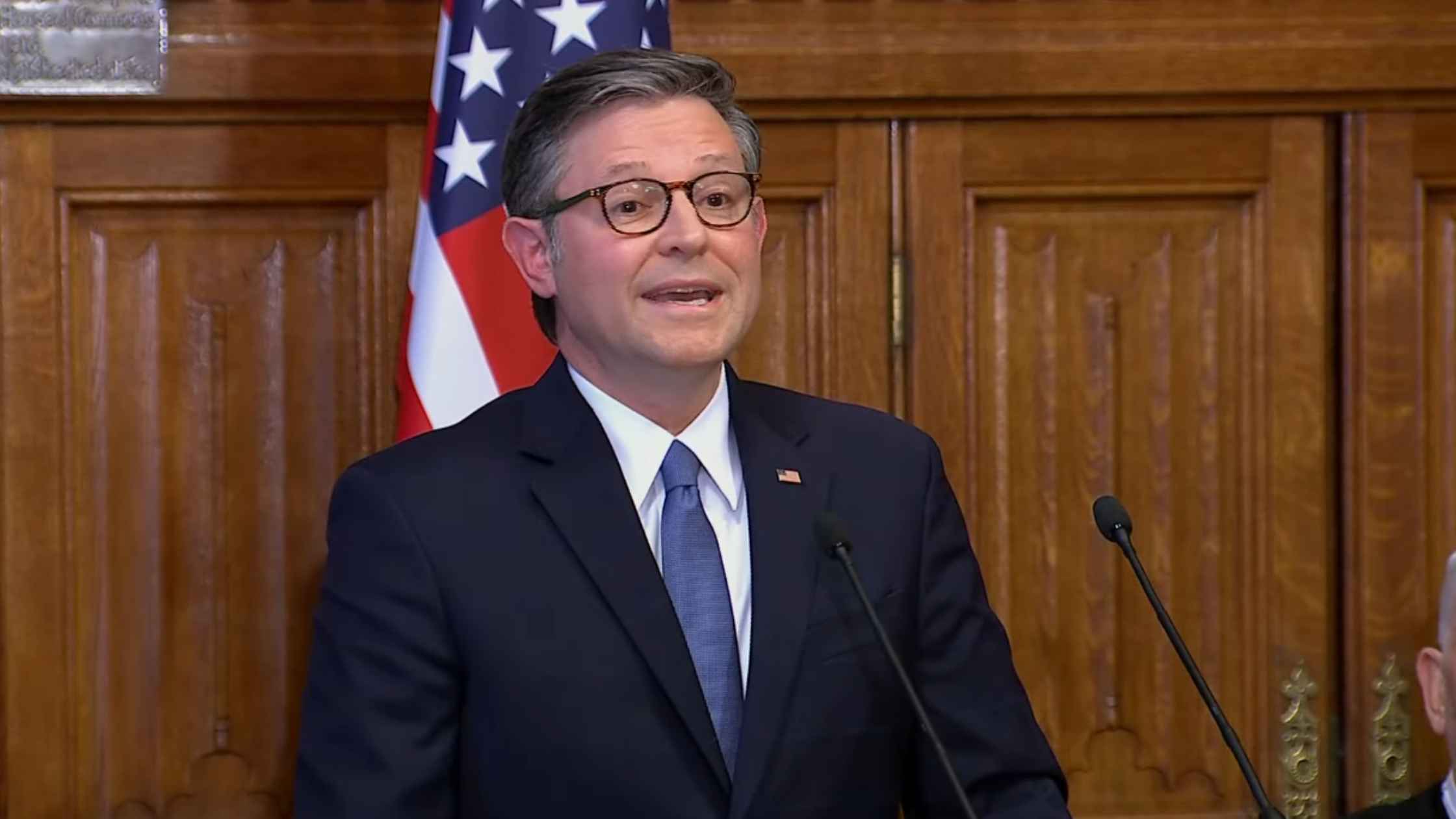

Johnson Addresses UK Lawmakers

U.S. House Speaker Mike Johnson delivers a speech in the UK Parliament in London. Read the transcript here.

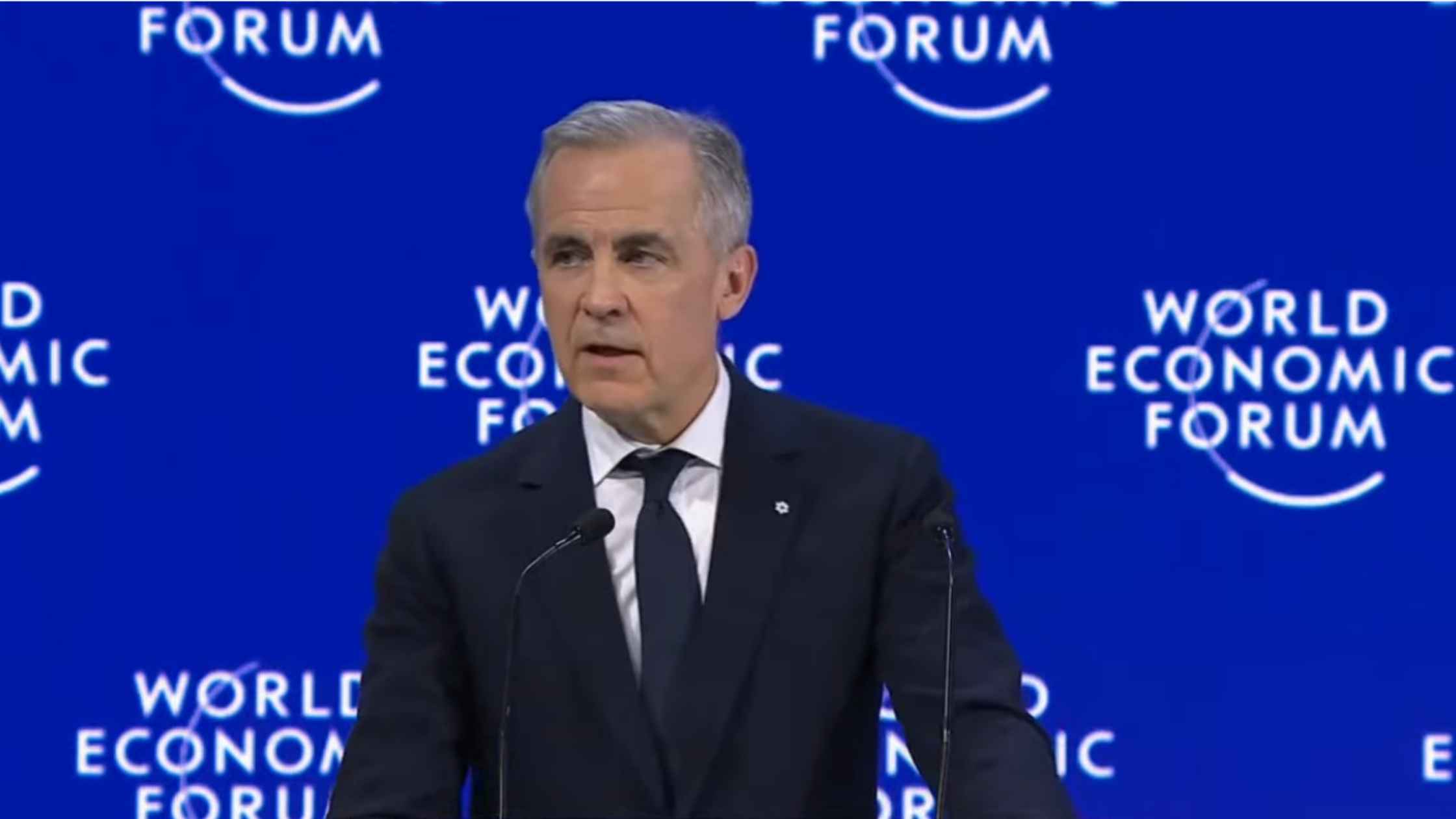

Carney at Davos

Canadian Prime Minister Mark Carney delivers a special address at the 2026 World Economic Forum in Davos. Read the transcript here.

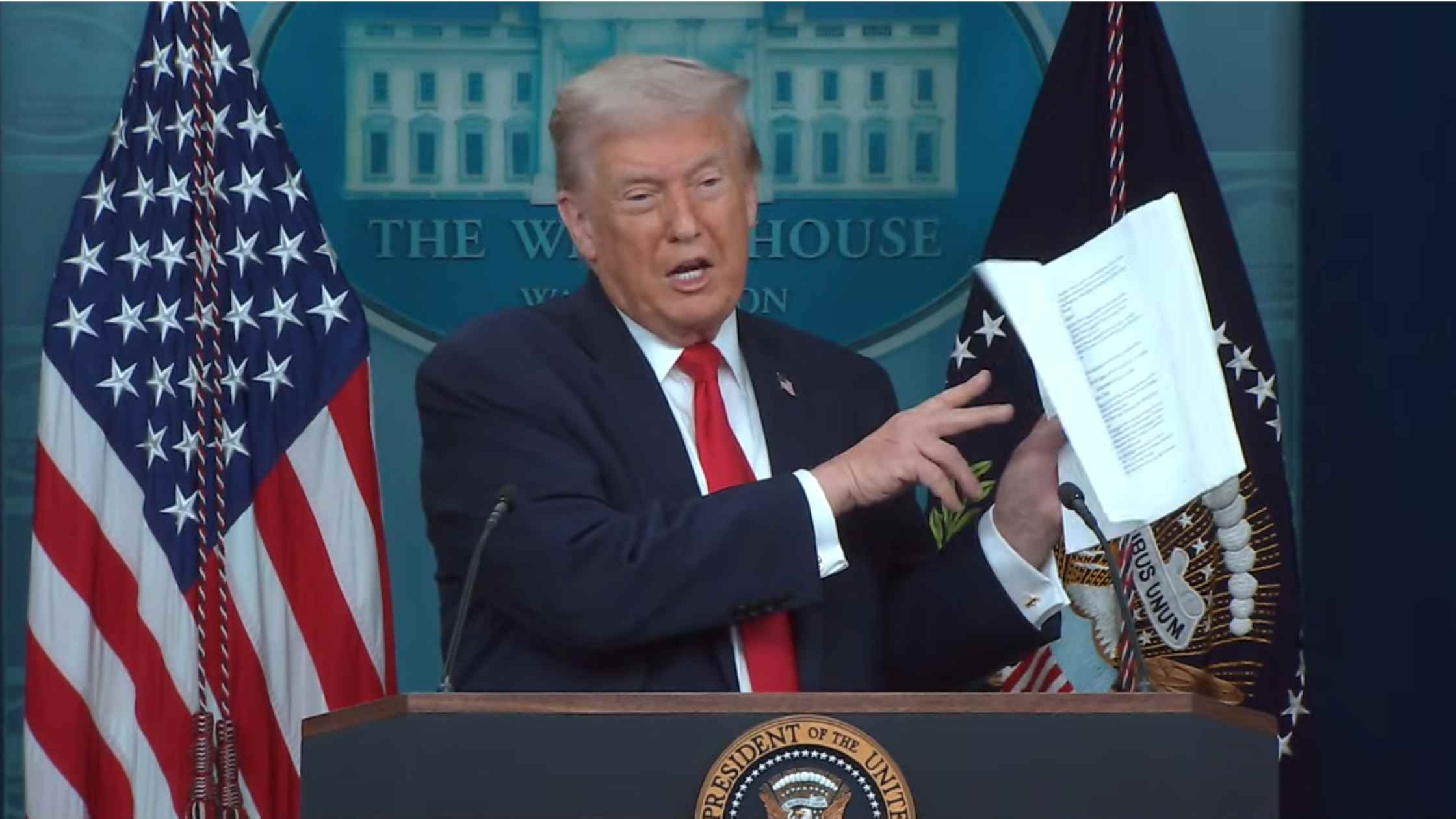

Donald Trump White House Press Briefing on 1/20/26

Donald Trump holds the White House Press Briefing for 1/20/26. Read the transcript here.

Bessent at Davos

U.S. Treasury Secretary Scott Bessent speaks at a news conference in Davos, Switzerland, at the 2026 World Economic Forum. Read the transcript here.

Carney Speaks after Meeting China’s Xi Jinping

Canadian Prime Minister Mark Carney speaks to the press in Beijing after meeting with Xi Jinping. Read the transcript here.

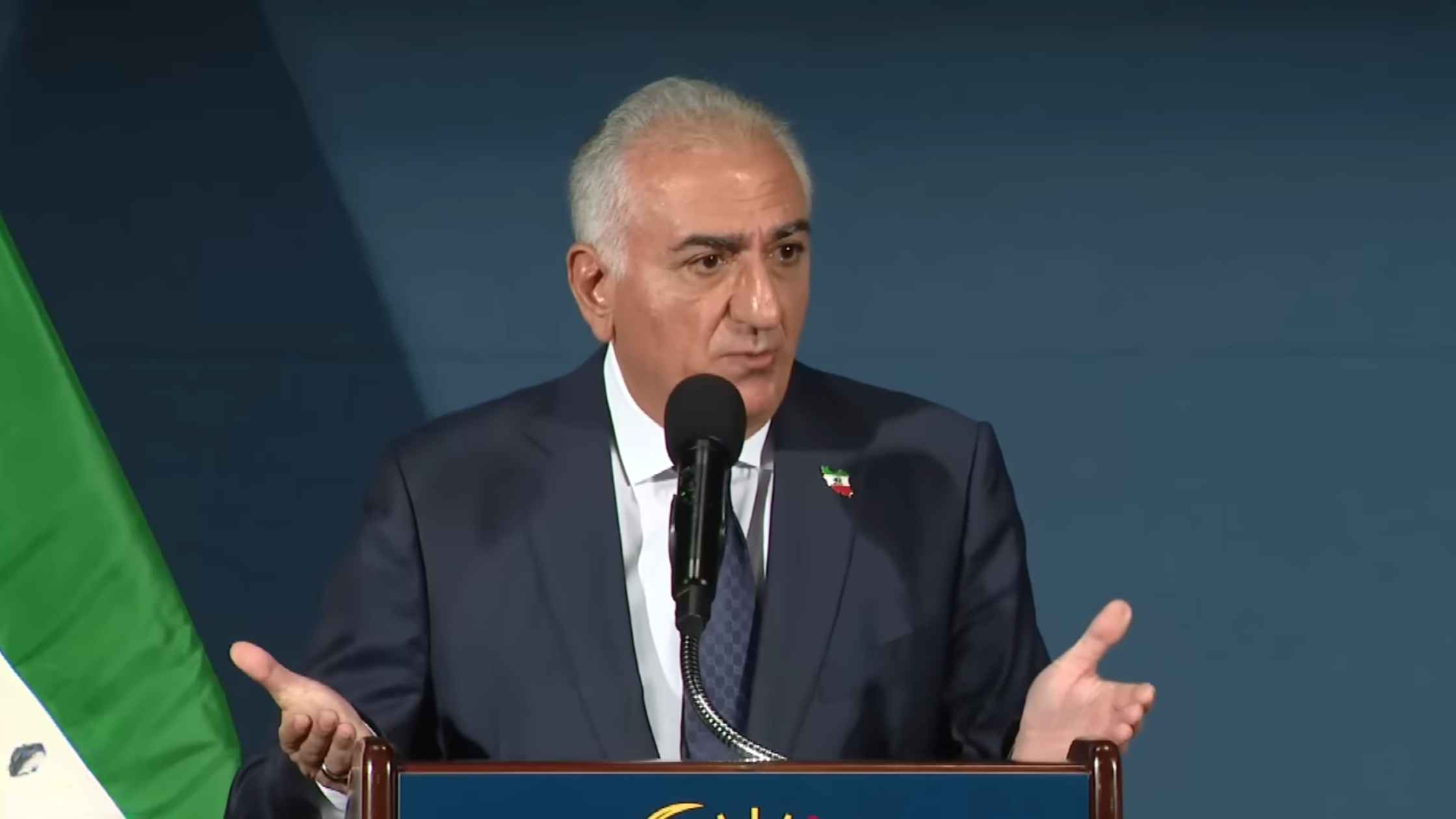

Reza Pahlavi News Conference

Exiled Crown Prince Reza Pahlavi holds a news conference on the future of Iran. Read the transcript here.

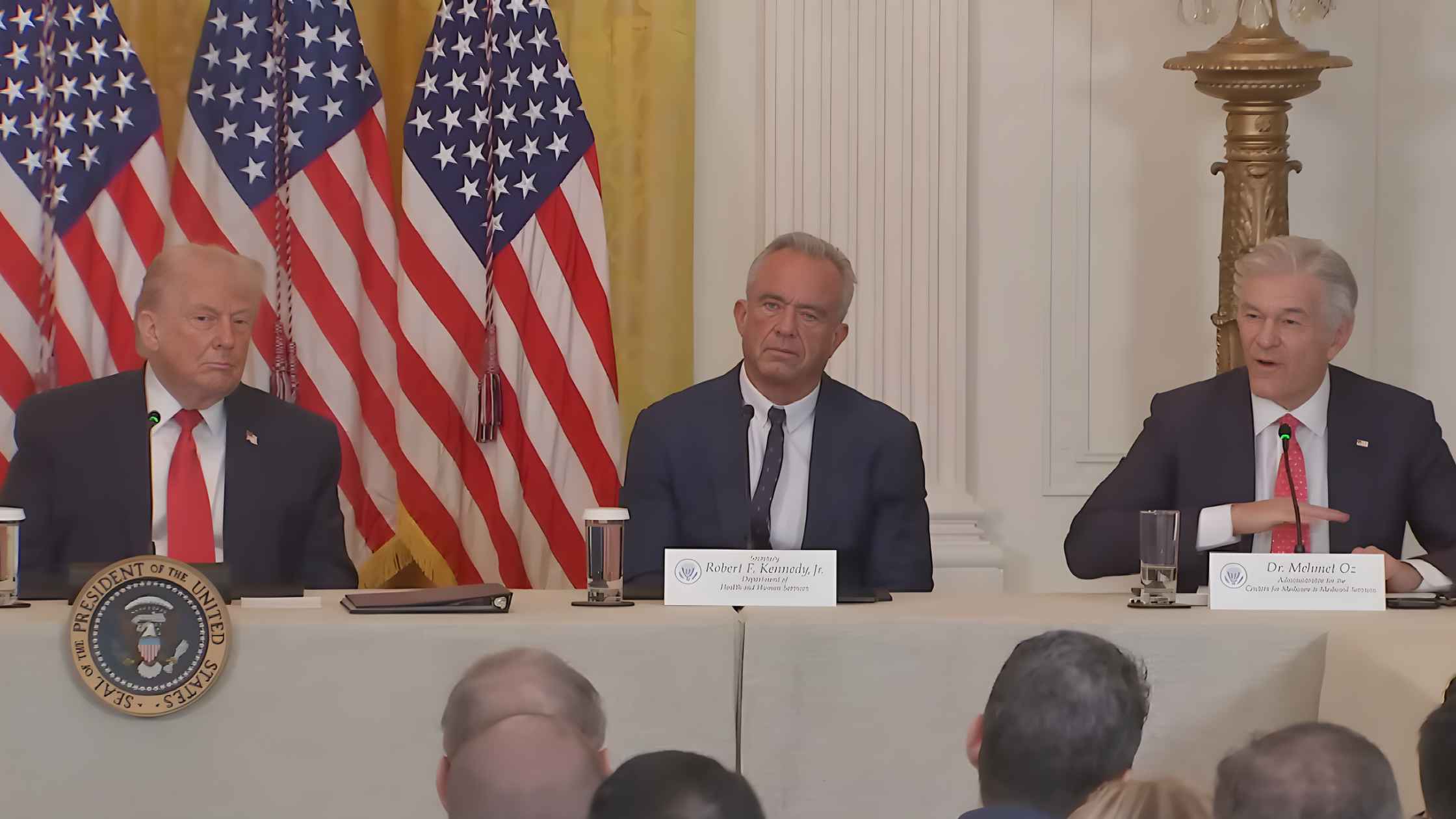

Rural Health Roundtable

Donald Trump takes part in a rural healthcare roundtable alongside RFK Jr., Dr. Oz, and other health officials. Read the transcript here.

Maria Corina Machado Press Conference

Maria Corina Machado holds a press conference after giving her Nobel Peace Prize medal to Donald Trump. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.