Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

Kid Rock Testifies Before The Senate Commerce Committee

Kid Rock gives testimony in the Senate Ticketmaster hearing calling to end concert ticket price gouging. Read the transcript here.

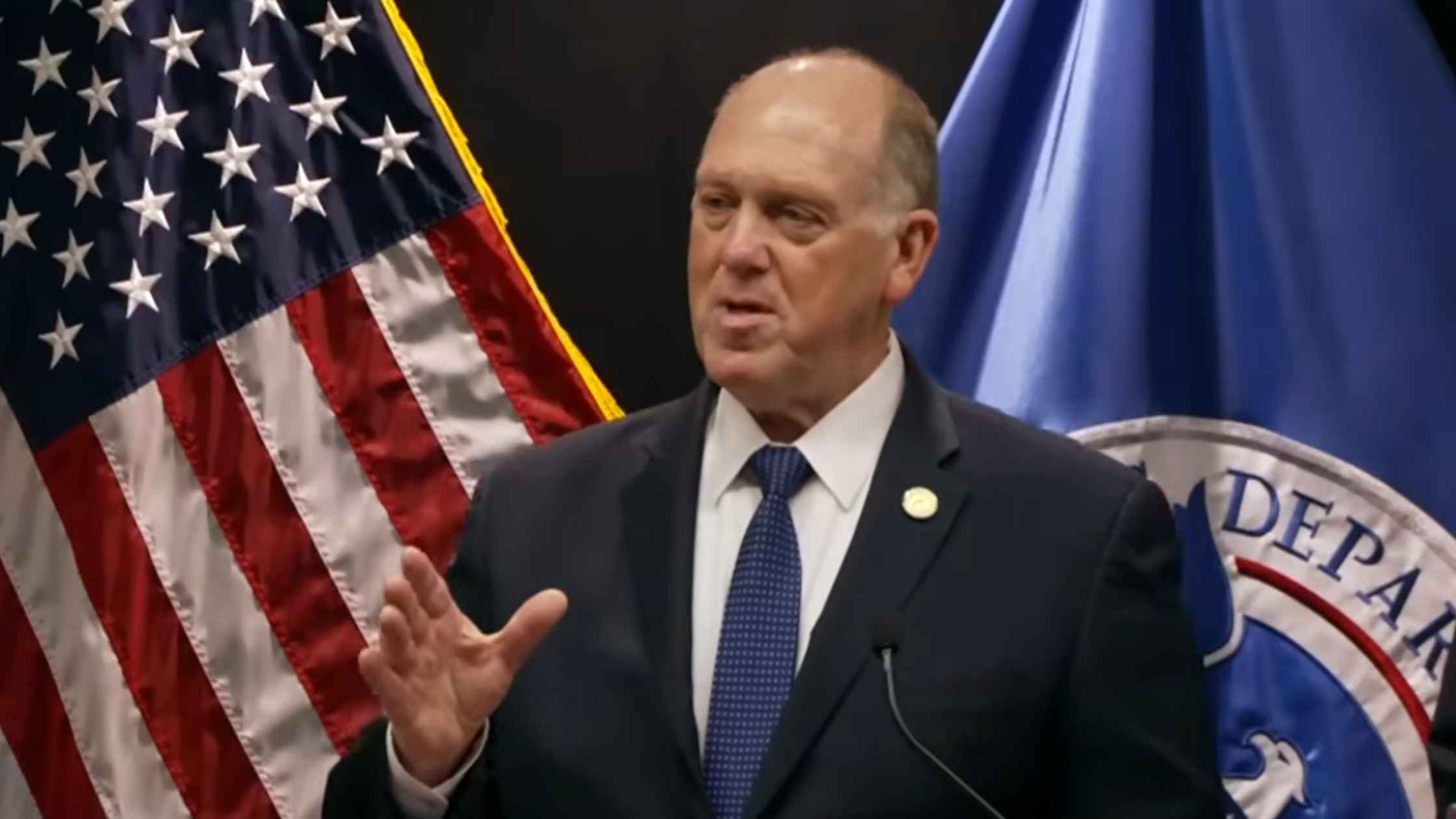

Tom Homan Press Conference

Border czar Tom Homan holds a news conference in Minneapolis, Minnesota. Read the transcript here.

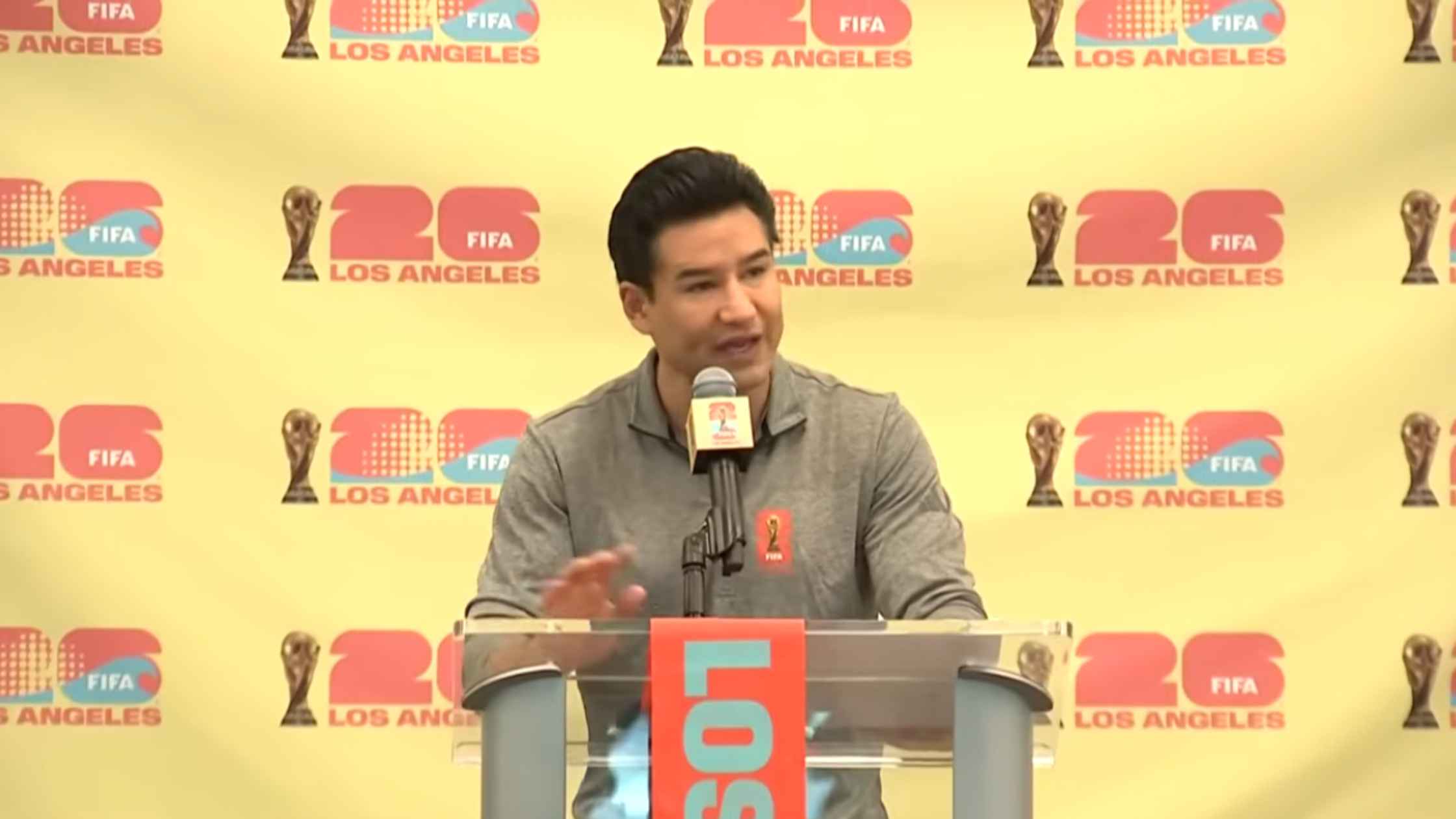

World Cup Update

The World Cup Committee unveils community and fan engagement plans for the tournament. Read the transcript here.

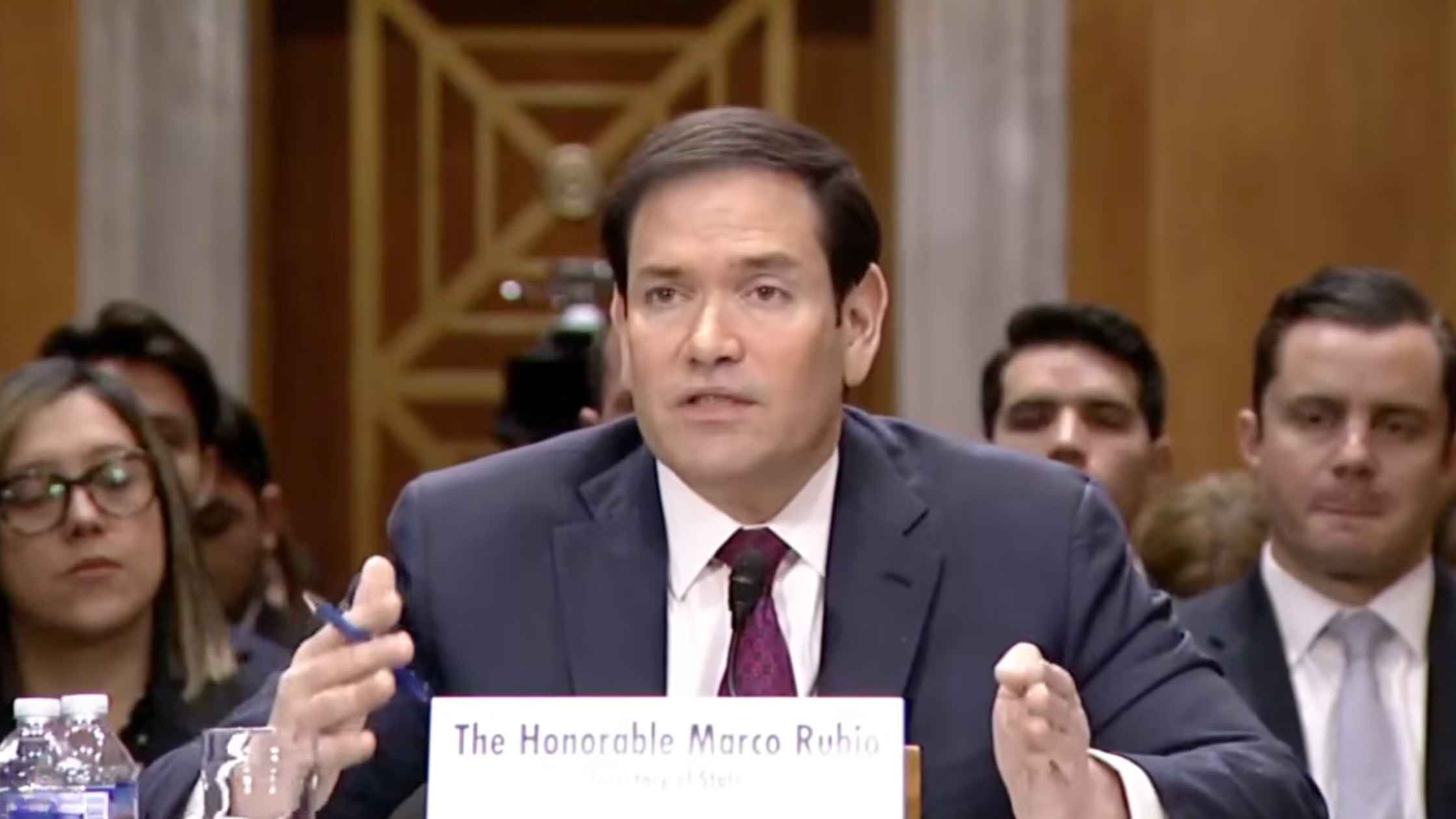

Venezuela Policy Congressional Hearing

Marco Rubio testifies at a Senate hearing on U.S. policy toward Venezuela. Read the transcript here.

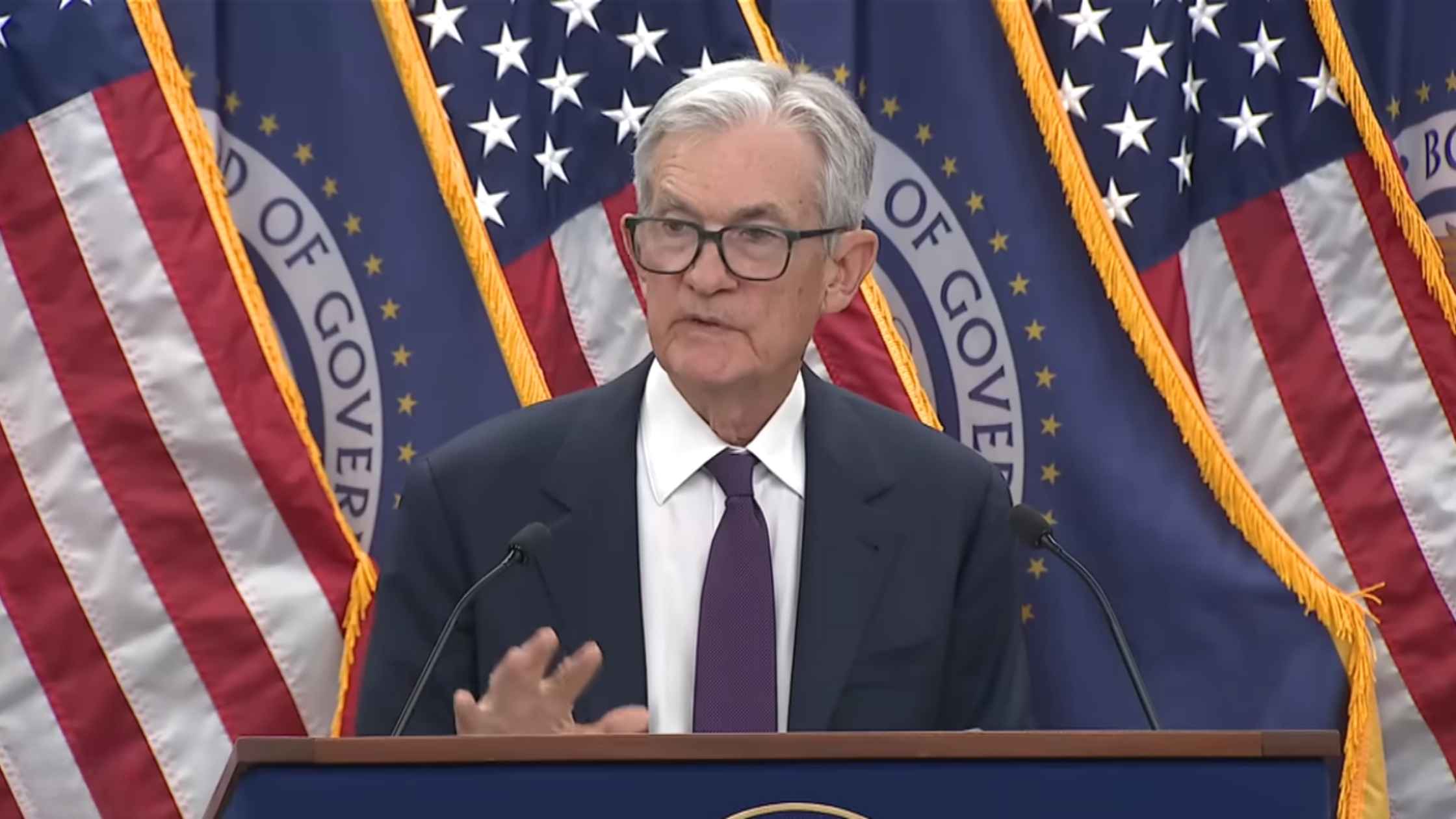

Fed Chair Statement on Interest Rates

Fed chair Jerome Powell holds a news conference on interest rate decision. Read the transcript here.

Trump Accounts Summit

Donald Trump and others speak at the Trump Accounts Summit. Read the transcript here.

Ilhan Omar Accosted at Town Hall

Ilhan Omar was shouted at and had liquid sprayed on her by an individual at a town hall in Minneapolis. Read the transcript here.

Arizona Shooting Press Conference

Pima County Sheriff holds a press conference on Arizona Border Patrol shooting. Read the transcript here.

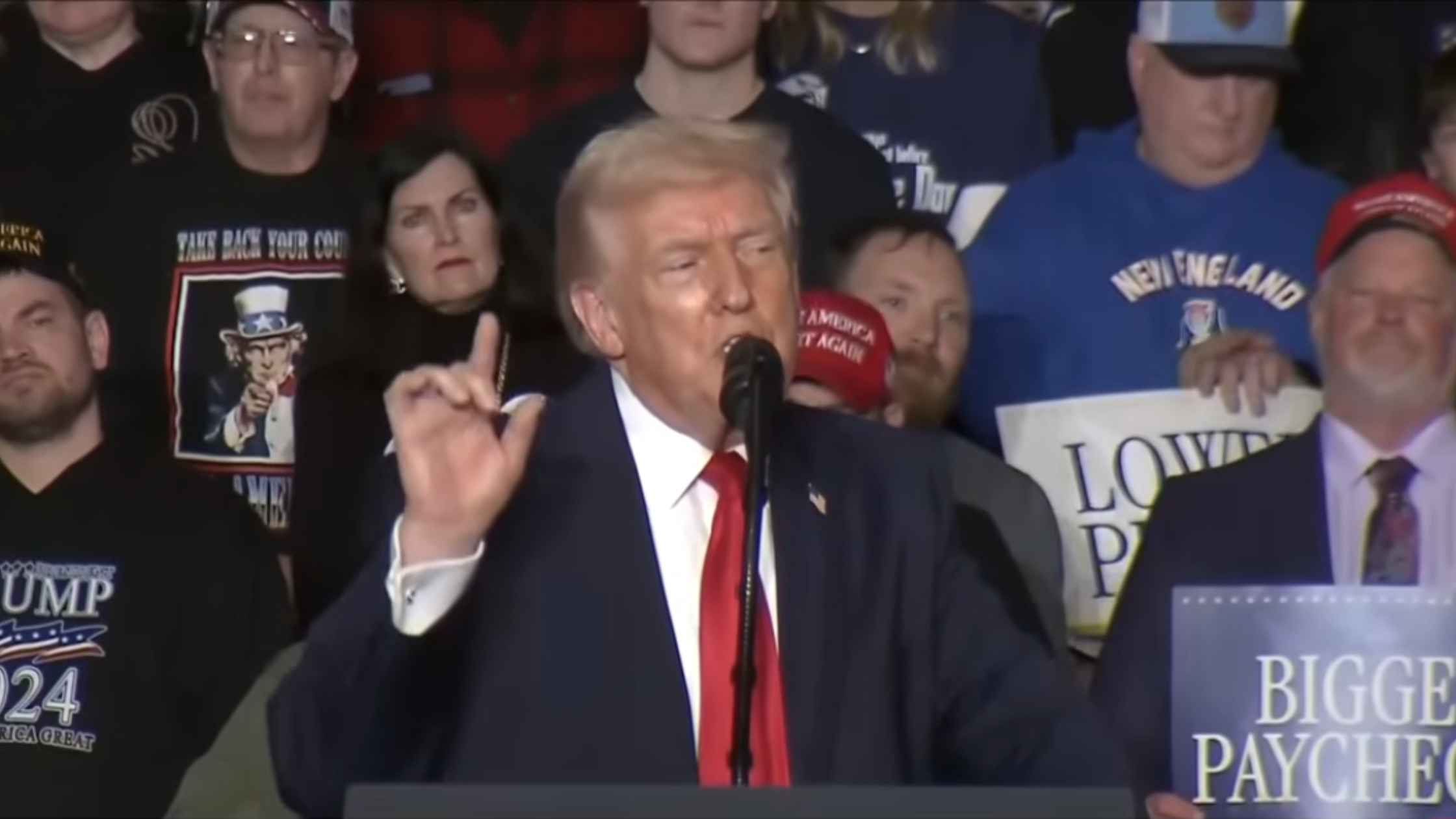

Trump Remarks in Iowa 1/27/26

Donald Trump delivers remarks on the economy in Clive, Iowa on 1/27/26. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.