Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

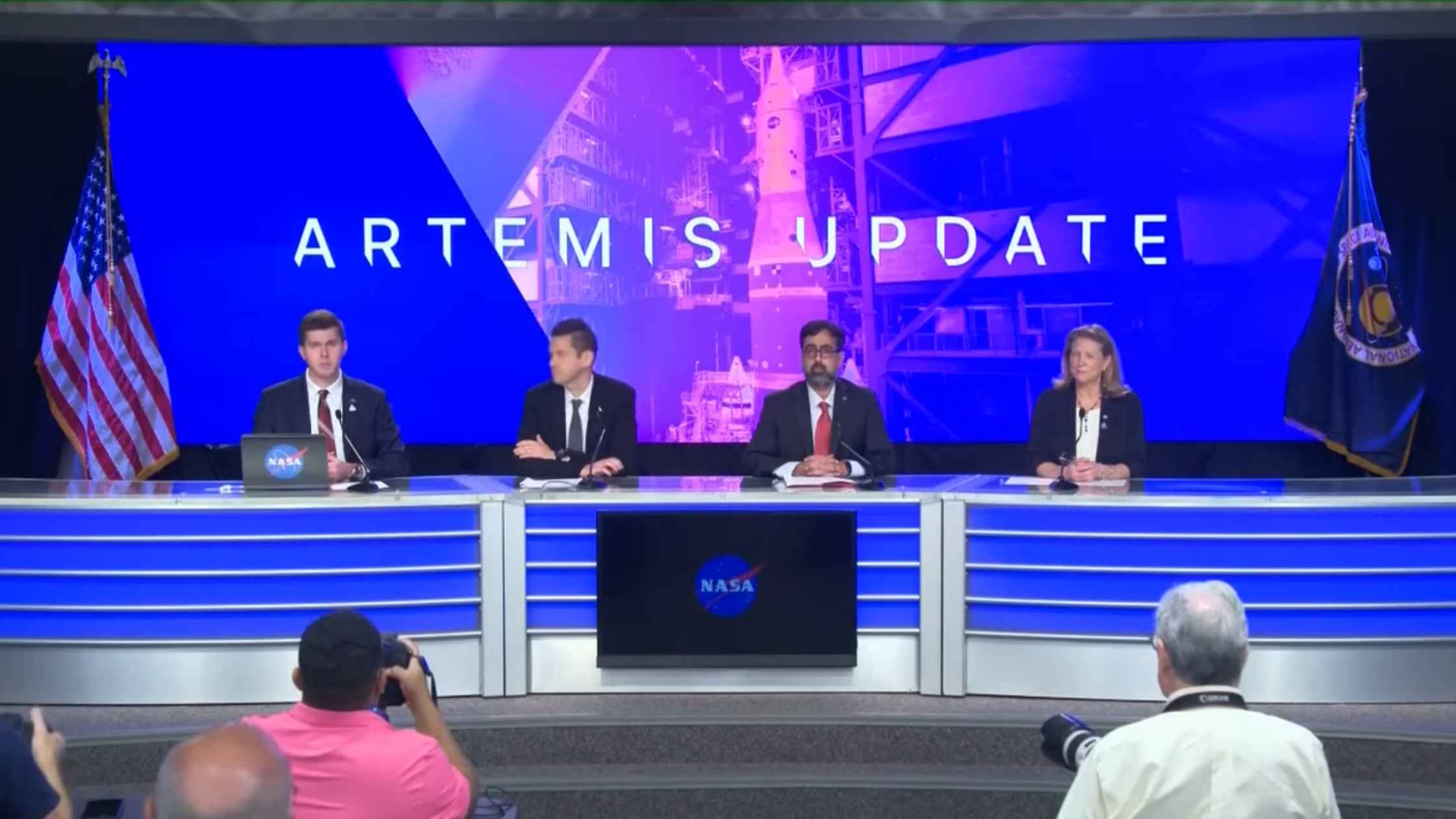

Artemis Update

NASA holds a news conference to provide an update on the Artemis II mission. Read the transcript here.

Trump Speaks on Energy in Texas

Donald Trump talks about energy in Texas ahead of a high-profile primary election. Read the transcript here.

Clinton Speaks after Testifying

Hillary Clinton speaks after testifying in the House Epstein investigation. Read the transcript here.

U.N. Security Council Emergency Meeting on Iran

The United Nations Security Council holds an emergency meeting after the U.S.-Israeli strikes on Iran. Read the transcript here.

Major Combat Operations in Iran

Donald Trump announces major combat operations in Iran. Read the transcript here.

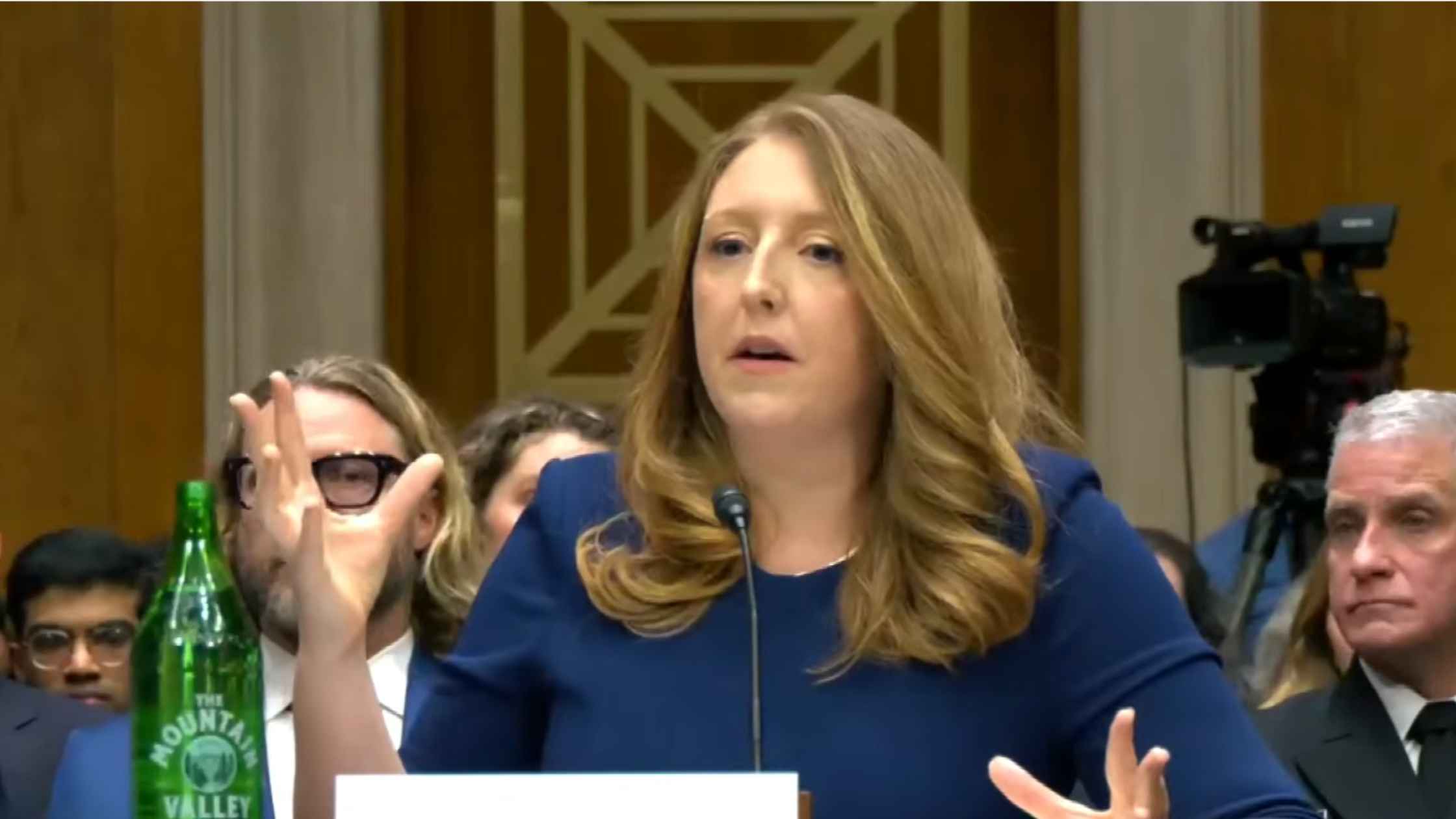

Surgeon General Confirmation Hearing

Casey Means testifies at Senate confirmation hearing for Surgeon General. Read the transcript here.

USDA Announcement

Agriculture Secretary Brooke Rollins announces initiative to update and modernize USDA facilities. Read the transcript here.

Vance and Oz on Medicare Fraud

JD Vance and Dr. Oz announce withholding of Medicaid funds in Minnesota over fraud claims. Read the transcript here.

Rubio on Cuban Speedboat Incident

Secretary of State Marco Rubio speaks after Cuba claims it carried out a deadly strike on a U.S. speedboat in Cuban waters. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.