Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

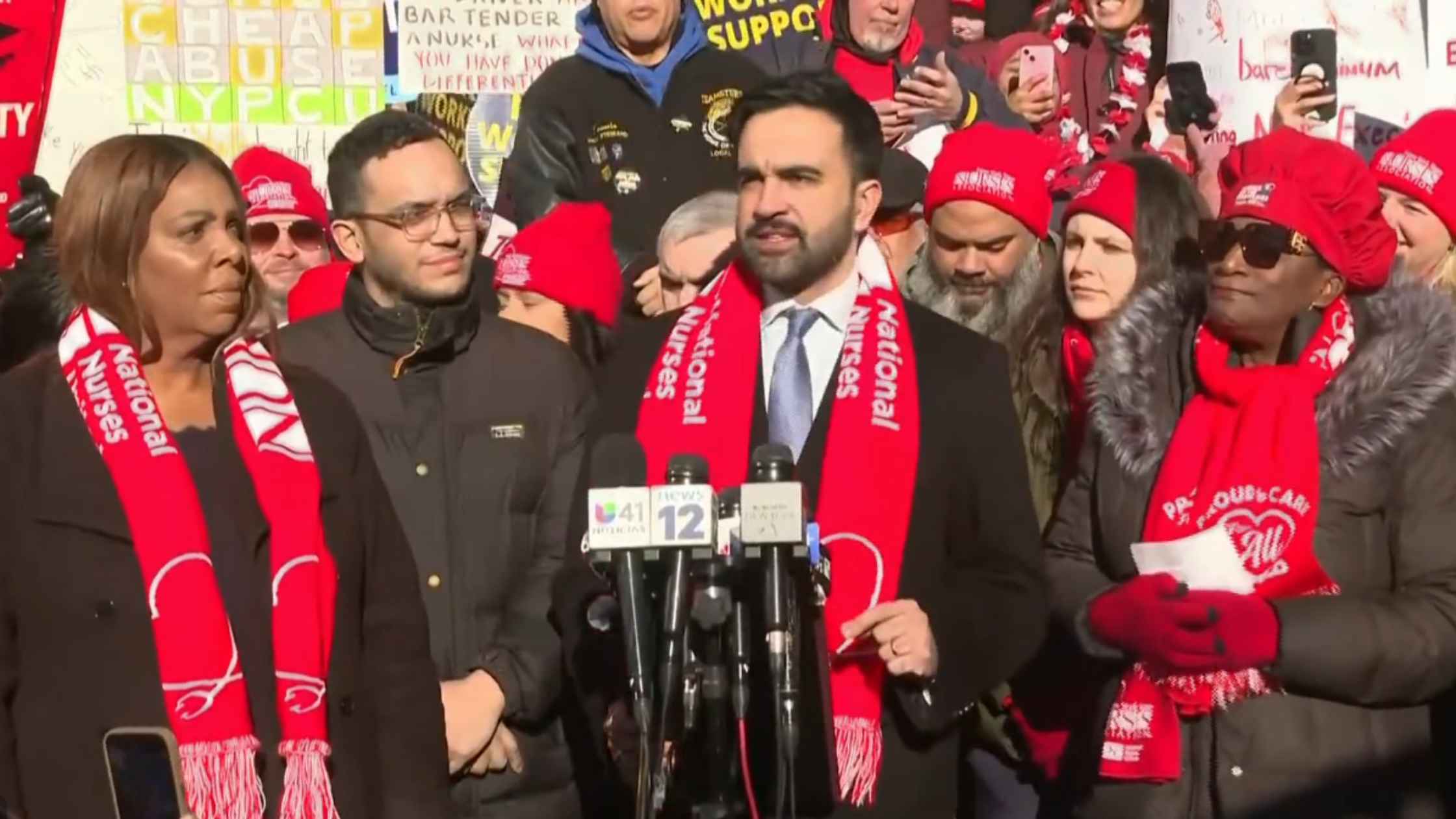

Nurse Strike Press Conference

A press conference was held as thousands of nurses at several major New York City hospitals went on strike. Read the transcript here.

U.N. Humanitarian Briefing

The United Nations hold a briefing in Geneva on humanitarian crises in the world. Read the transcript here.

Hegseth Speaks at SpaceX

Secretary of War Pete Hegseth and SpaceX founder Elon Musk speak at the SpaceX headquarters in Brownsville, Texas. Read the transcript here.

Minnesota Attorney General Press Conference

AG Keith Ellison holds a briefing, along with Minneapolis Mayor Jacob Frey, after the state filed a lawsuit against Kristi Noem. Read the transcript here.

2026 Golden Globes Recap

Best moments of the 2026 83rd Annual Golden Globes. Read the transcript here.

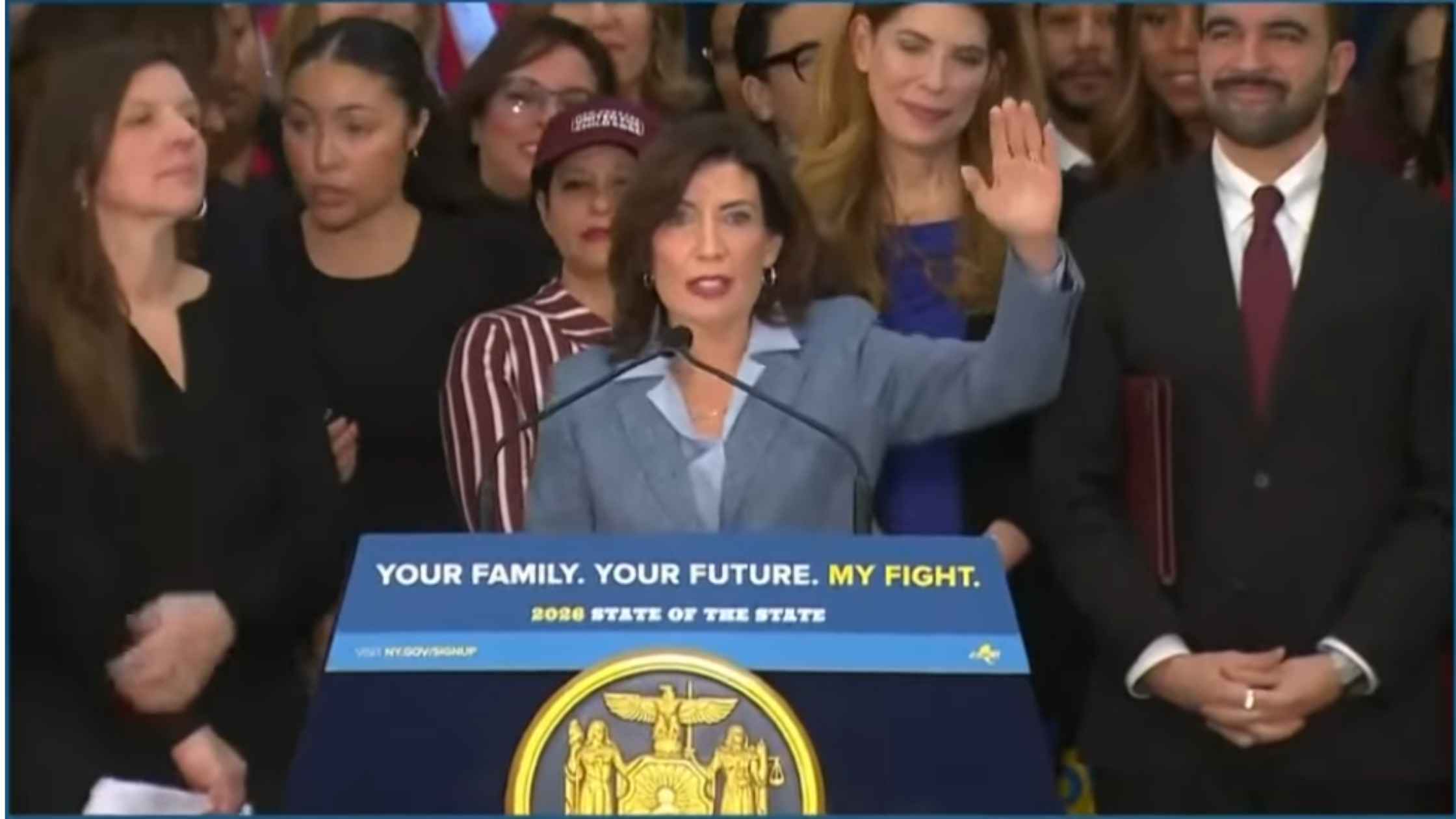

NY Universal Childcare Announcement

NY Governor Kathy Hochul and NYC Mayor Zohran Mamdani unveil a new free child care plan with a path to statewide universal childcare. Read the transcript here.

White House Meeting with Oil Executives

Donald Trump meets with oil executives at the White House to discuss potential investments to revive Venezuela's oil sector. Read the transcript here.

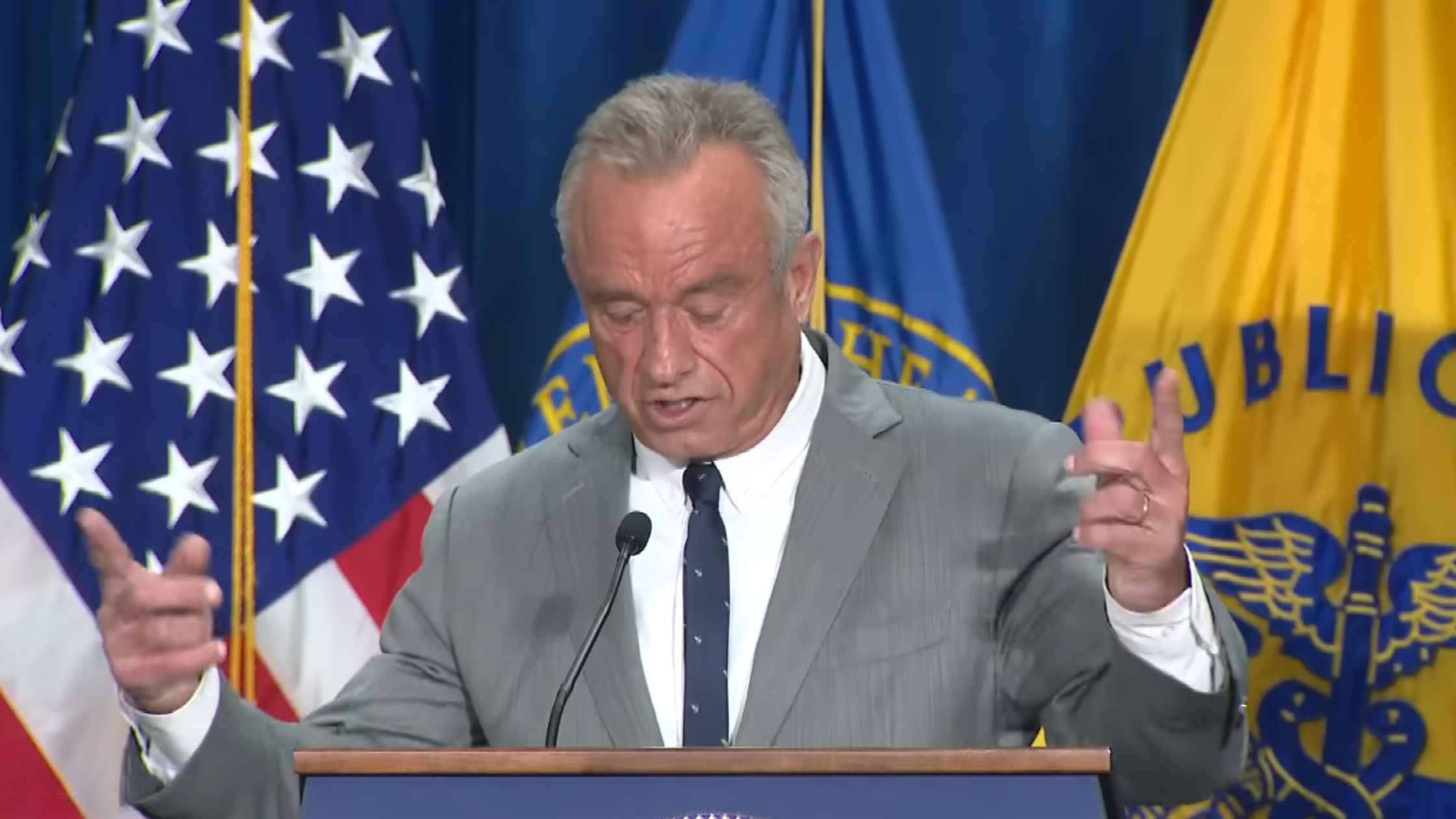

New White House Dietary Guidelines

HHS Secretary Robert F. Kennedy Jr. and other officials announced new dietary guidelines, including prioritizing high-quality protein. Read the transcript here.

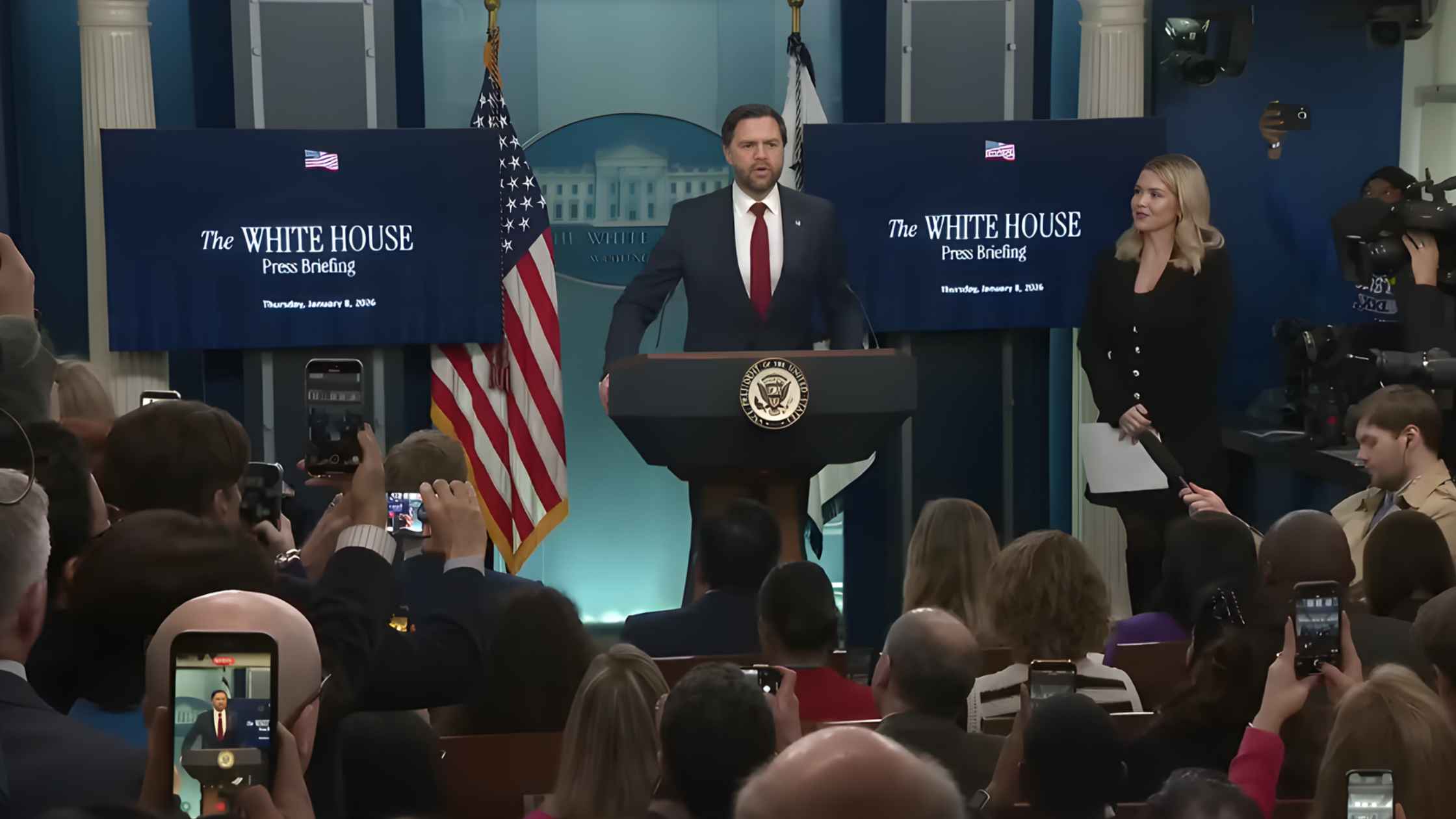

Karoline Leavitt White House Press Briefing on 1/08/26

Karoline Leavitt holds the White House Press Briefing for 1/08/26. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.