Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

Remembering Rob Reiner

A look back at the life and work of acclaimed film director and actor Rob Reiner. Read the transcript here.

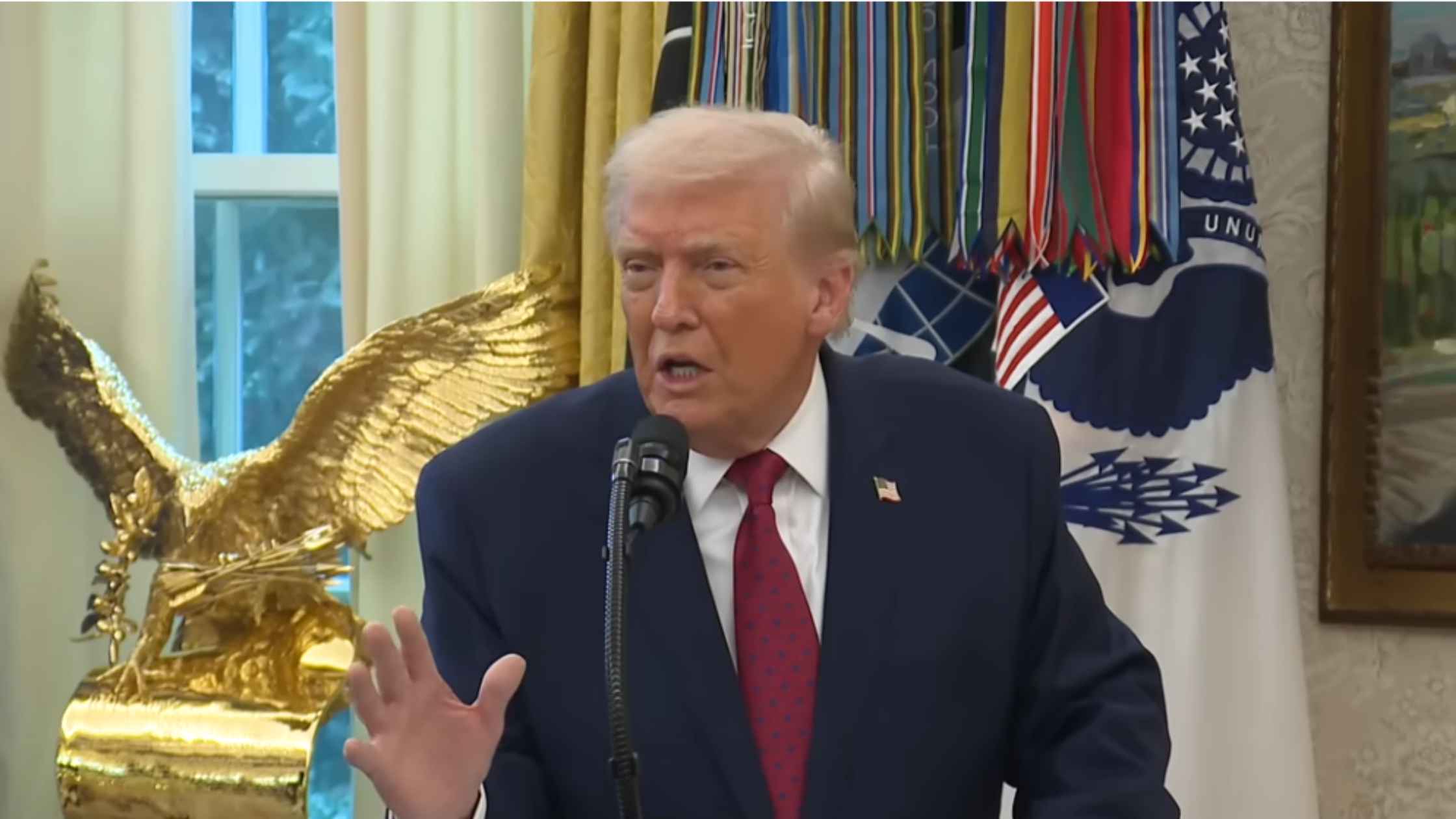

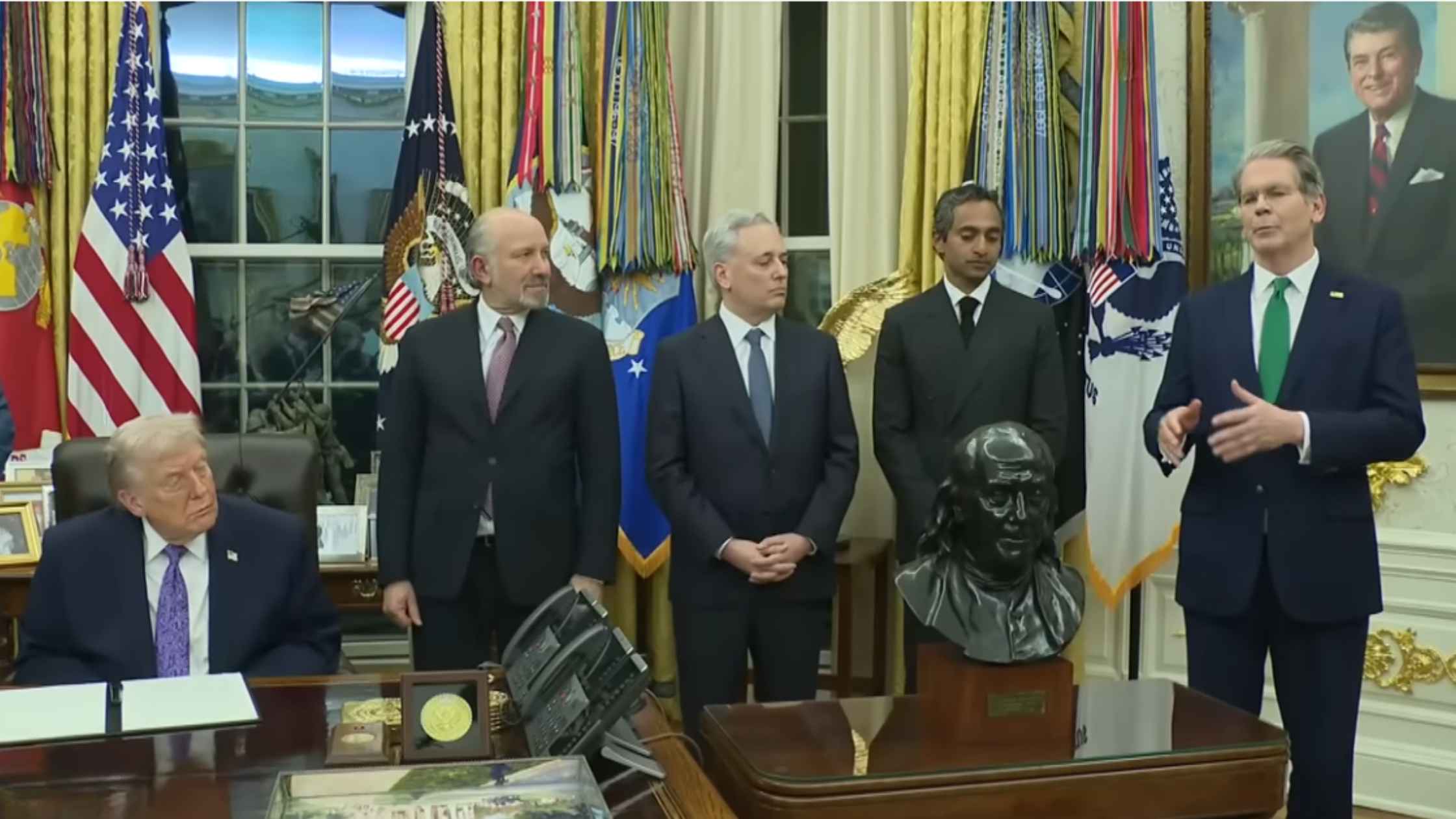

Border Medal Presentation

Donald Trump participates in a Mexican Border Defense Medal presentation. Read the transcript here.

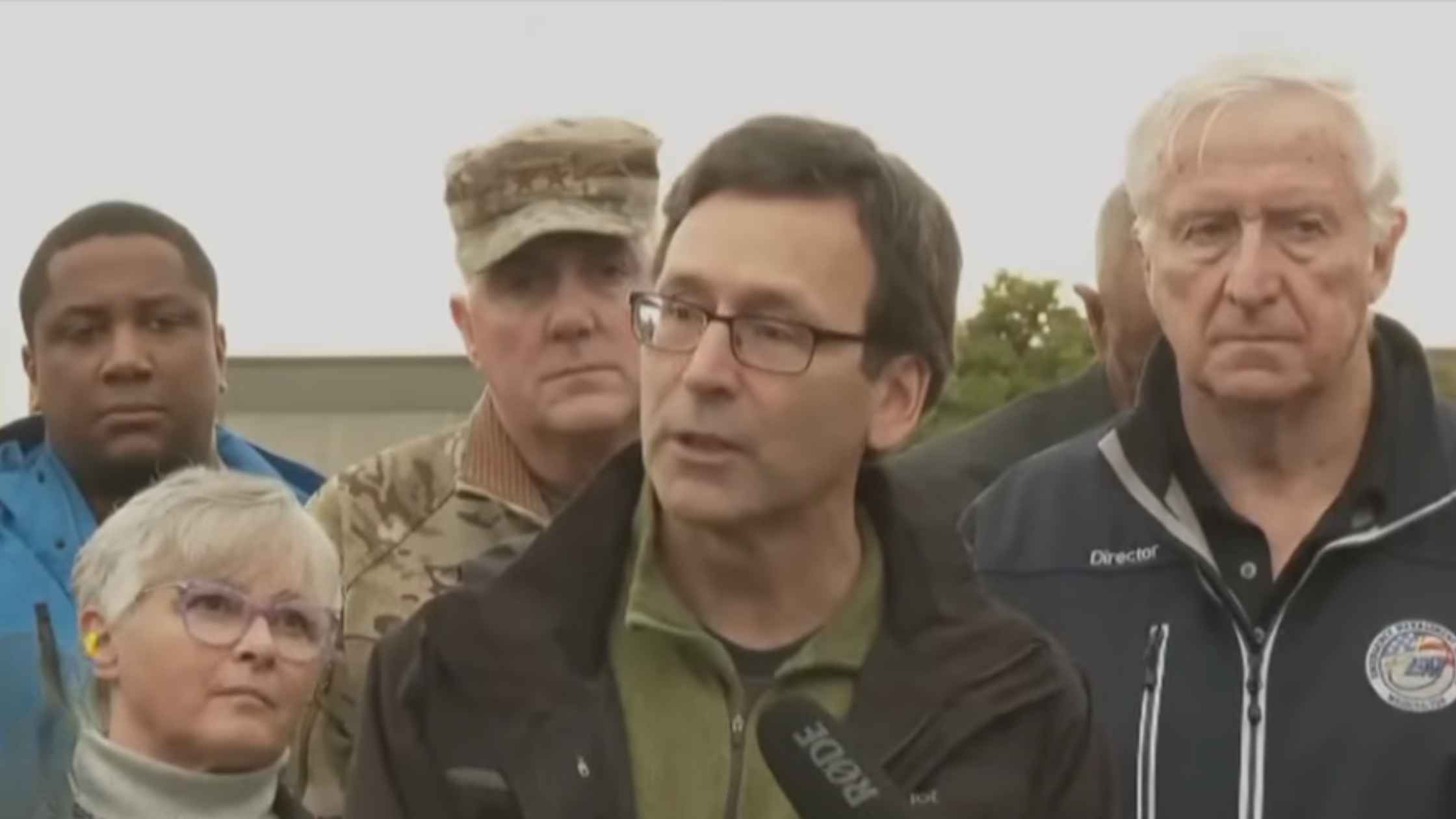

Brown Shooting Update

Officials hold a press briefing on the shooting at Brown University. Read the transcript here.

Bondi Beach Shooting Update

Officials hold a press briefing to provide updates on the deadly mass shooting in Bondi Beach, Australia. Read the transcript here.

Trump at Congressional Ball

Donald Trump delivers remarks at the Congressional Ball. Read the transcript here.

Washington Flood Update

Washington Governor Bob Ferguson provides an update on the state's response to flooding as heavy rains drench the Pacific Northwest. Read the transcript here.

AI Executive Order

Donald Trump signs an executive order to override AI regulations by the states. Read the transcript here.

Homeland Security Hearing 12/11/25

Kristi Noem testifies on global security threats to the U.S. in a House hearing on Homeland Security. Read the transcript here.

Karoline Leavitt White House Press Briefing on 12/11/25

Karoline Leavitt holds the White House Press Briefing for 12/11/25. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.