Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

Melania Trump Chairs United Nations Meeting

First Lady Melania Trump assumes the Security Council Presidency for a United Nations Security Council meeting. Read the transcript here.

UK Prime Minister Starmer Speaks on Iran Conflict

British Prime Minister Keir Starmer makes a statement in the House of Commons about the ongoing situation in Iran. Read the transcript here.

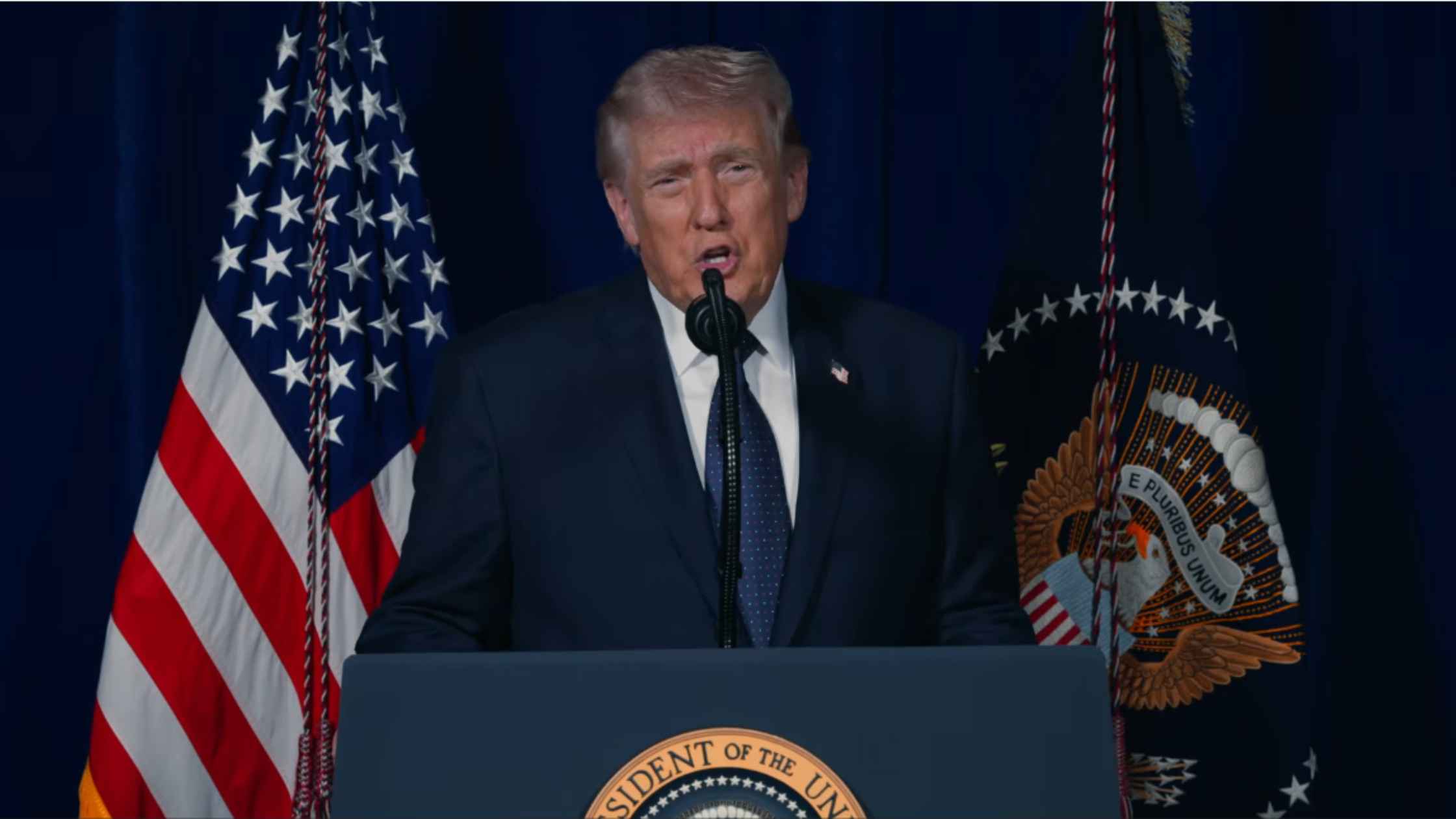

Medal of Honor Ceremony

Donald Trump speaks at a Medal of Honor ceremony at the White House. Read the transcript here.

Hegseth and Caine Hold Pentagon Press Briefing on Iran War

Pete Hegseth and General Dan Caine hold a Pentagon press briefing on the war in Iran. Read the transcript here.

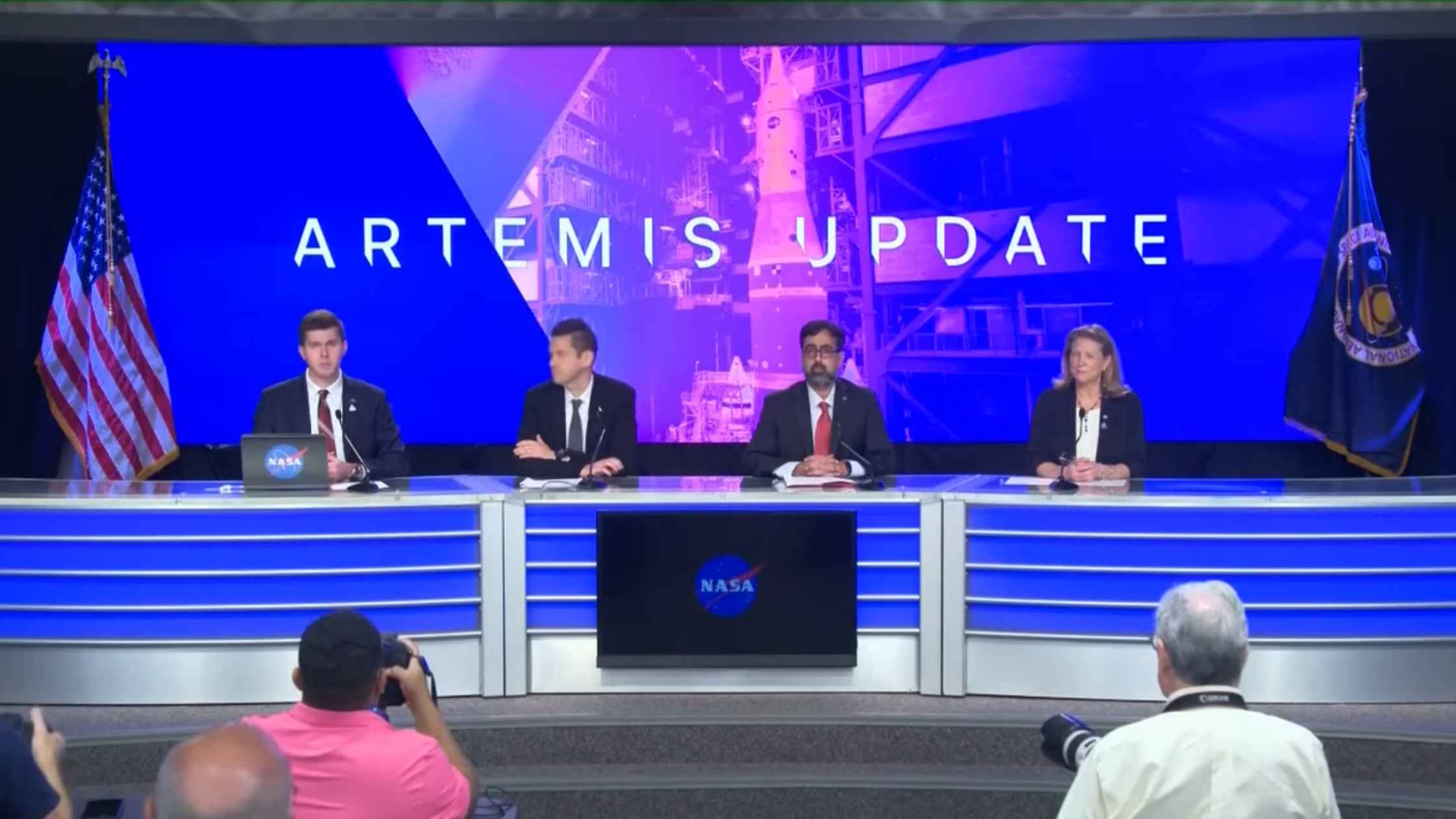

Artemis Update

NASA holds a news conference to provide an update on the Artemis II mission. Read the transcript here.

Trump Speaks on Energy in Texas

Donald Trump talks about energy in Texas ahead of a high-profile primary election. Read the transcript here.

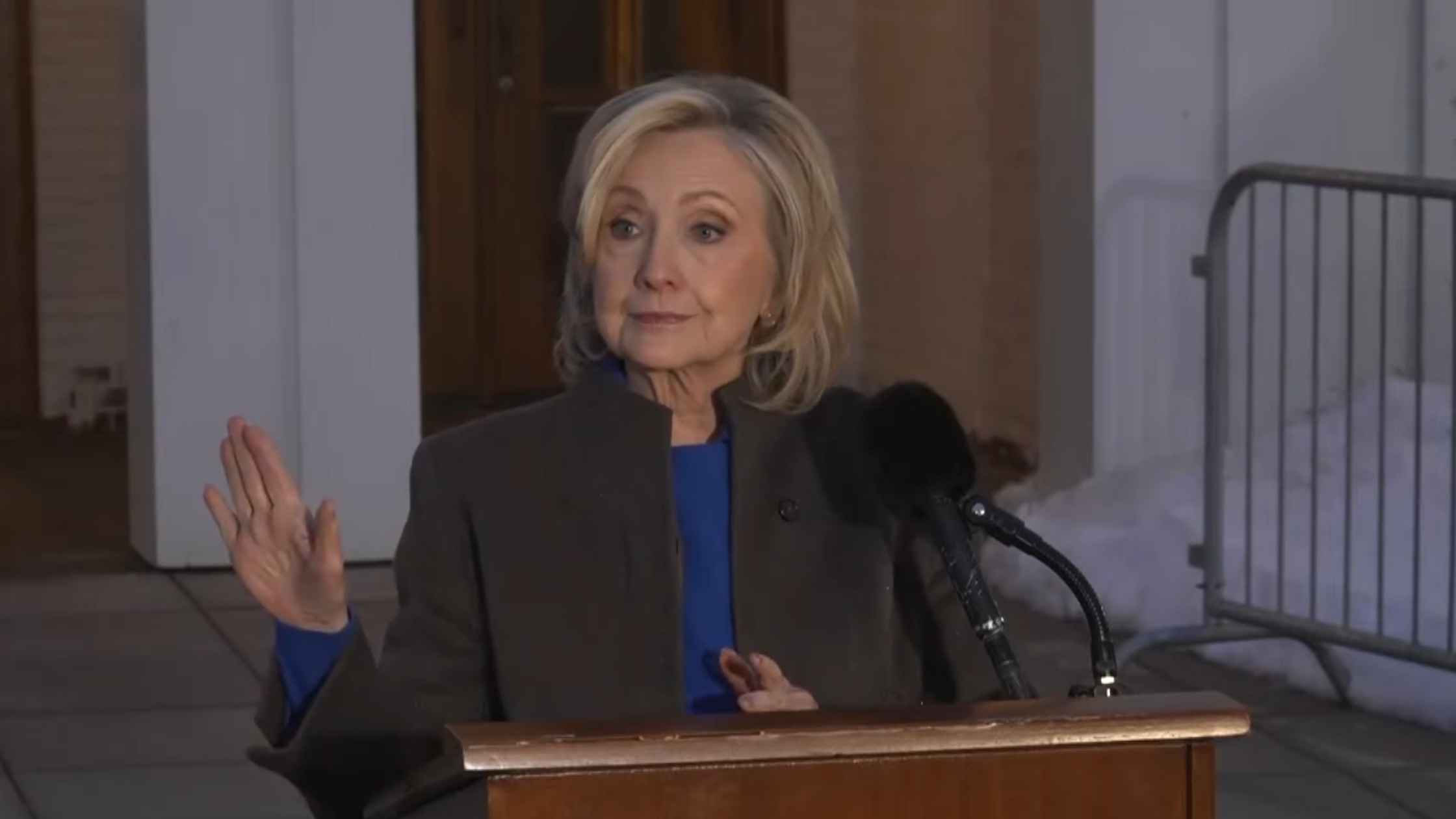

Clinton Speaks after Testifying

Hillary Clinton speaks after testifying in the House Epstein investigation. Read the transcript here.

U.N. Security Council Emergency Meeting on Iran

The United Nations Security Council holds an emergency meeting after the U.S.-Israeli strikes on Iran. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.