Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

Arctic Frost Congressional Testimony

Telecom executives testify before the Judiciary Committee on Arctic Frost. Read the transcript here.

Karoline Leavitt White House Press Briefing on 2/10/26

Karoline Leavitt holds the White House Press Briefing for 2/10/26. Read the transcript here.

Epstein Survivors Press Conference

Epstein survivors and lawmakers hold a news conference. Read the transcript here.

Lutnick Congressional Testimony

Commerce Secretary Howard Lutnick testifies before the Senate Appropriations Committee. Read the transcript here.

Hegseth at Bath Iron Works

Defense Secretary Pete Hegseth speaks at Bath Iron Works. Read the transcript here.

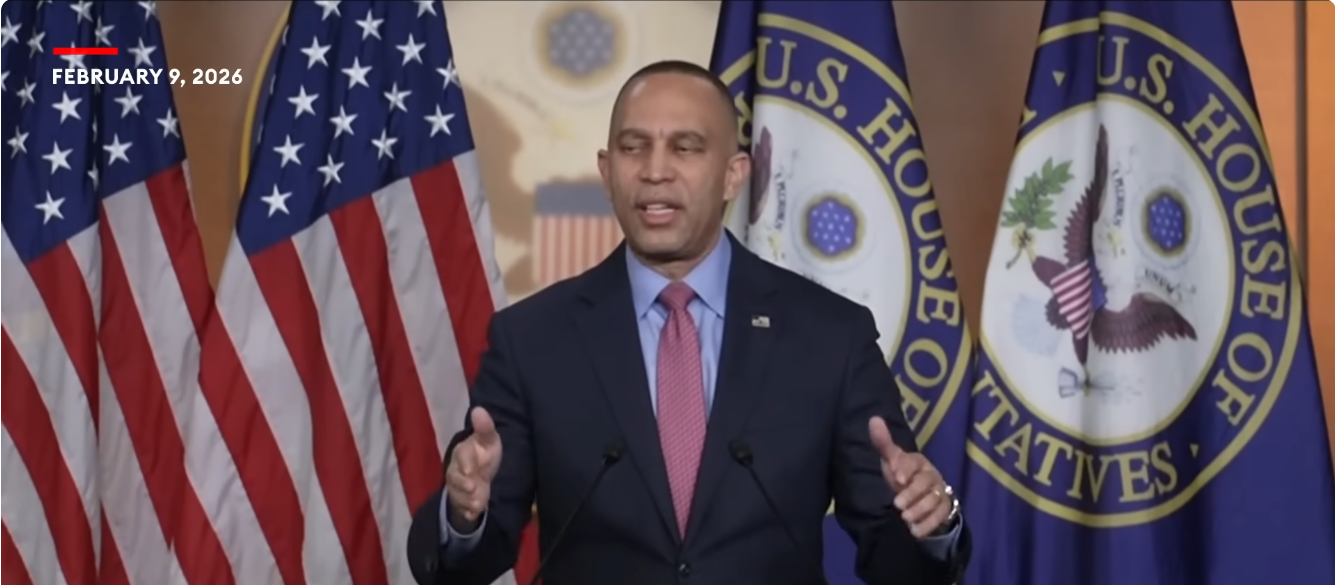

Democrat News Briefing 2/09/26

Hakeem Jeffries holds a Democrat news briefing on 2/09/26. Read the transcript here.

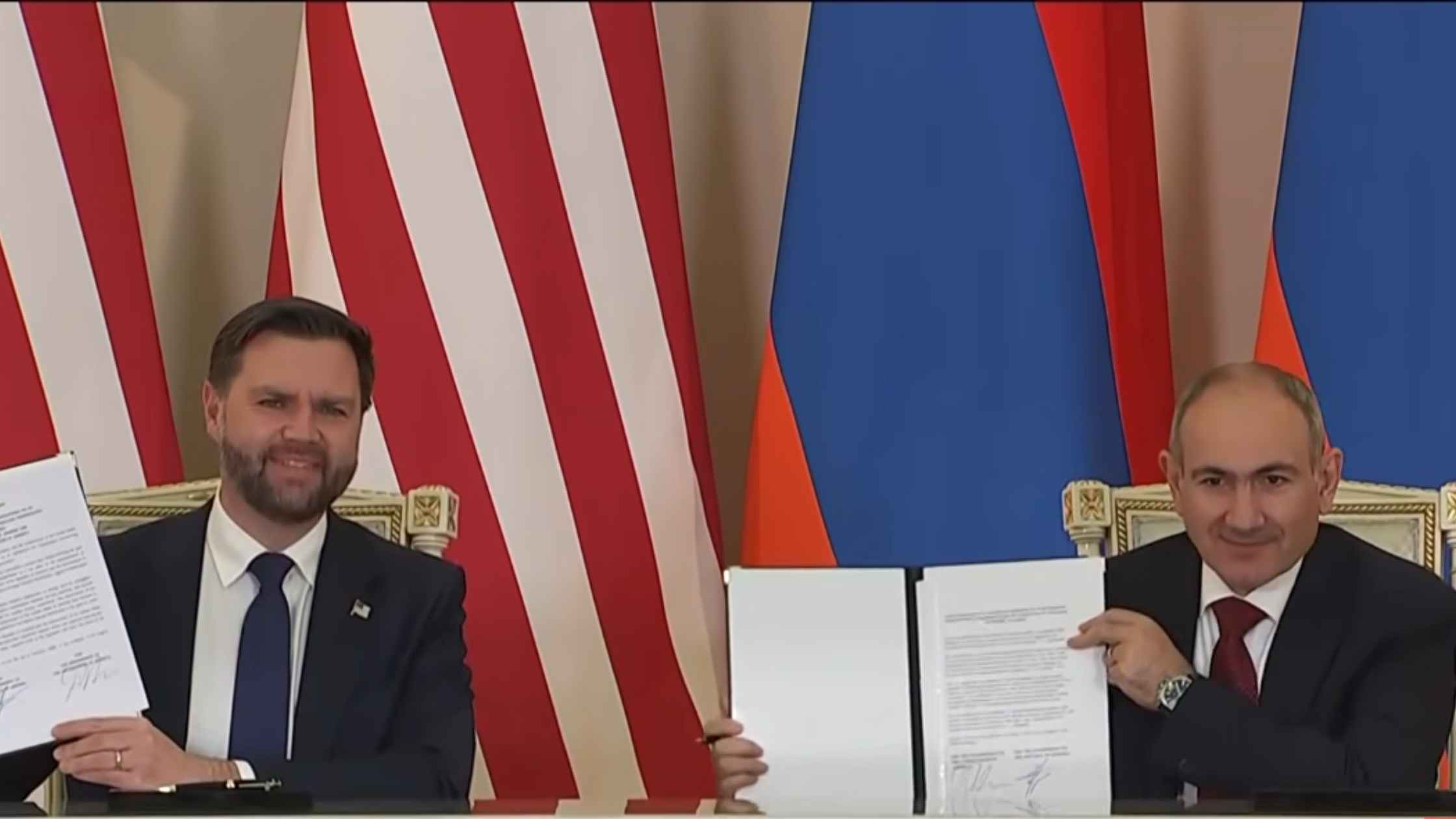

Armenian Nuclear Cooperation Deal

JD Vance and Armenian Prime Minister Nikol Pashinyan hold a press briefing after signing a nuclear cooperation agreement. Read the transcript here.

Massie and Khanna on Epstein Files

Thomas Massie and Ro Khanna hold a press briefing after viewing the unredacted Epstein files at the Department of Justice. Read the transcript here.

Super Bowl Post Press Conference

Super Bowl MVP Kenneth Walker III and Seahawks’ head coach Mike Macdonald speak following Super Bowl LX. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.