Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

DOT Safety Changes

Secretary of Transportation Sean Duffy announces new DOT Commercial Trucking safety efforts. Read the transcript here.

Bessent at Economic Club of Dallas

Treasury Secretary Scott Bessent delivers remarks at the Economic Club of Dallas. Read the transcript here.

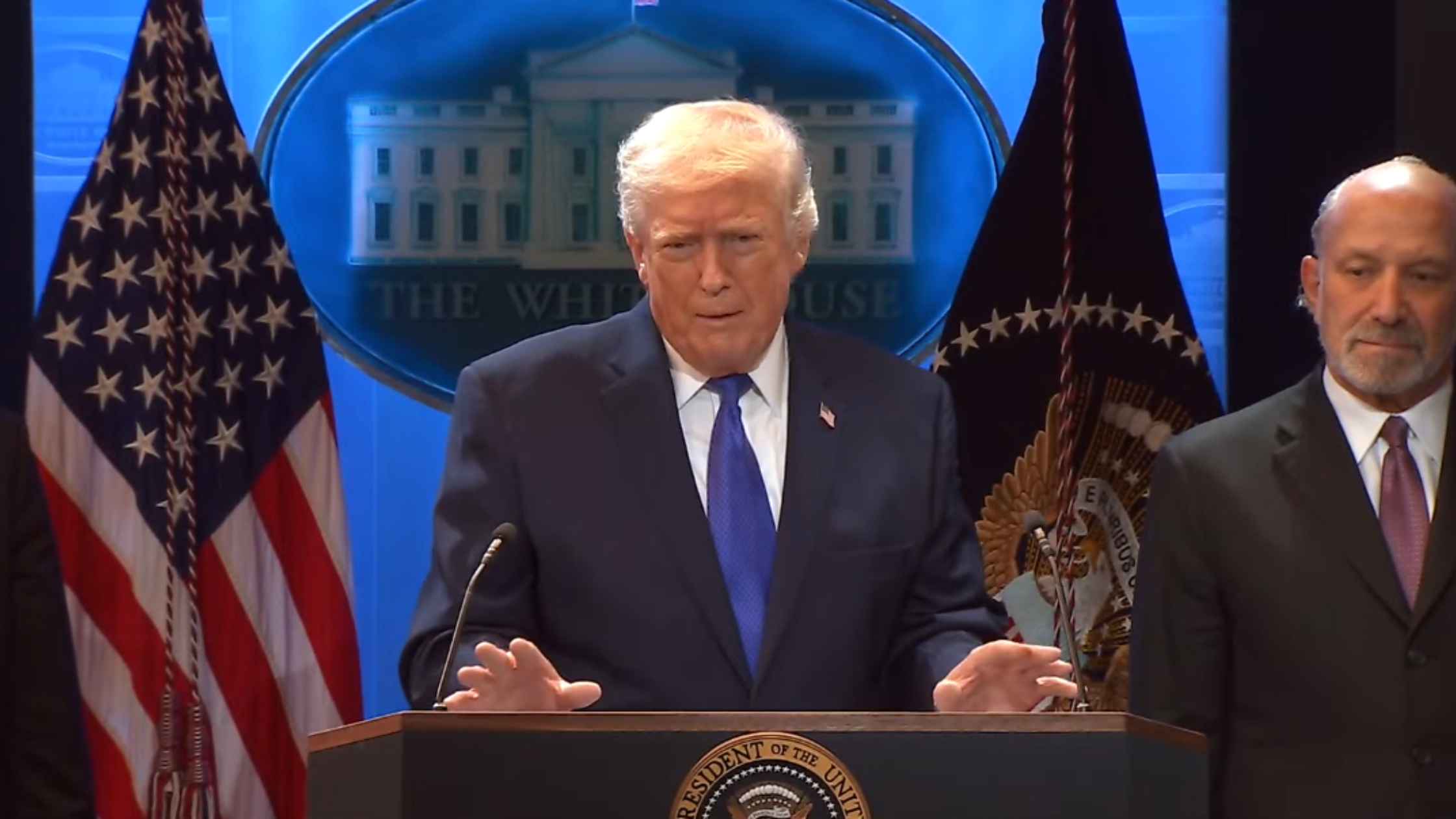

Tariff Ruling Response

Donald Trump responds to the Supreme Court ruling against his tariffs. Read the transcript here.

NYC Winter Storm Press Conference

NYC Mayor Zohran Mamdani holds a press conference ahead of winter storm. Read the transcript here.

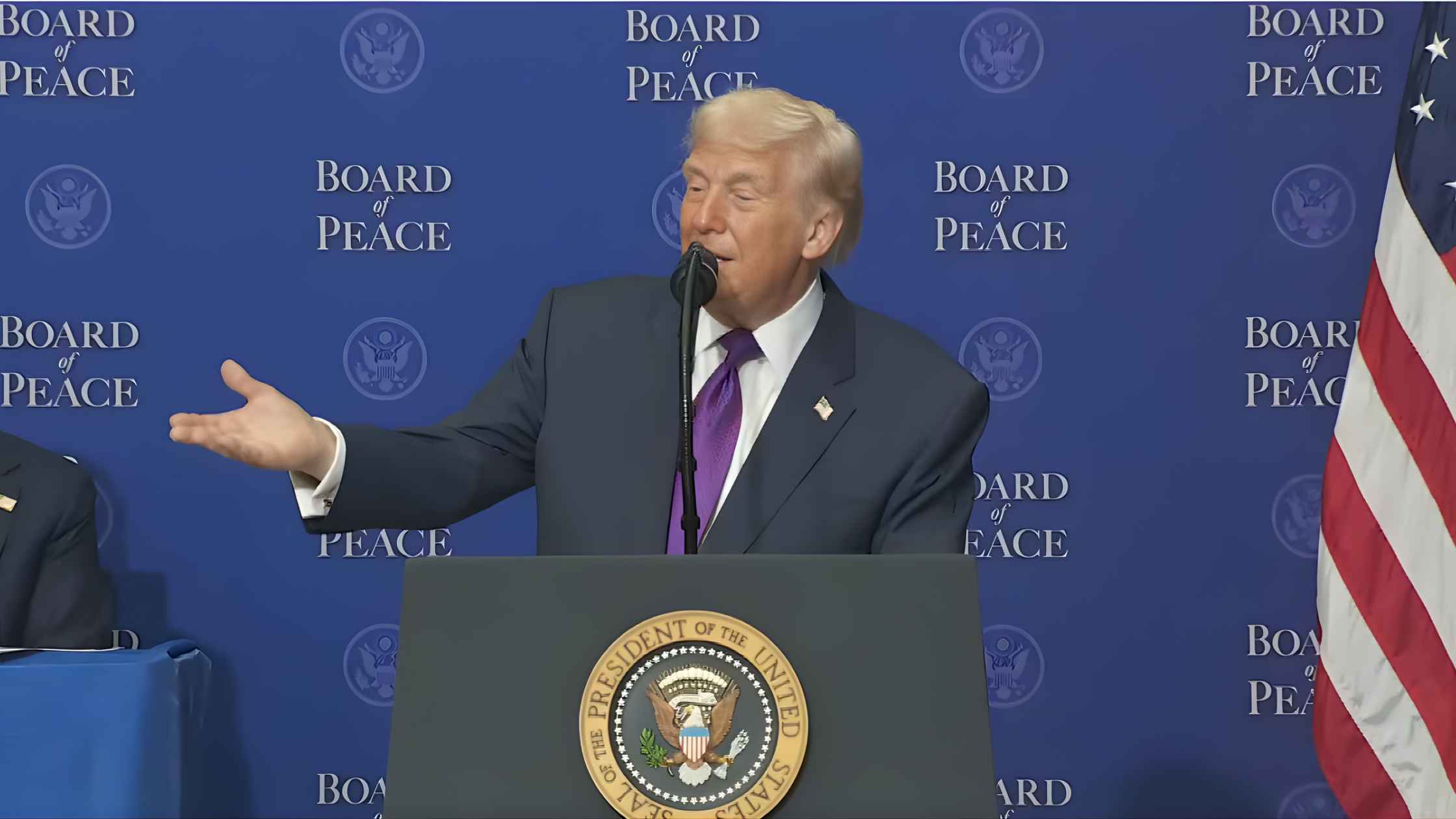

First Board of Peace Meeting

World leaders gather for Donald Trump’s inaugural Board of Peace meeting. Read the transcript here.

Avalanche Update Press Conference

Nevada County Sheriff's office holds a news briefing following the avalanche in California's Sierra Nevada mountains. Read the transcript here.

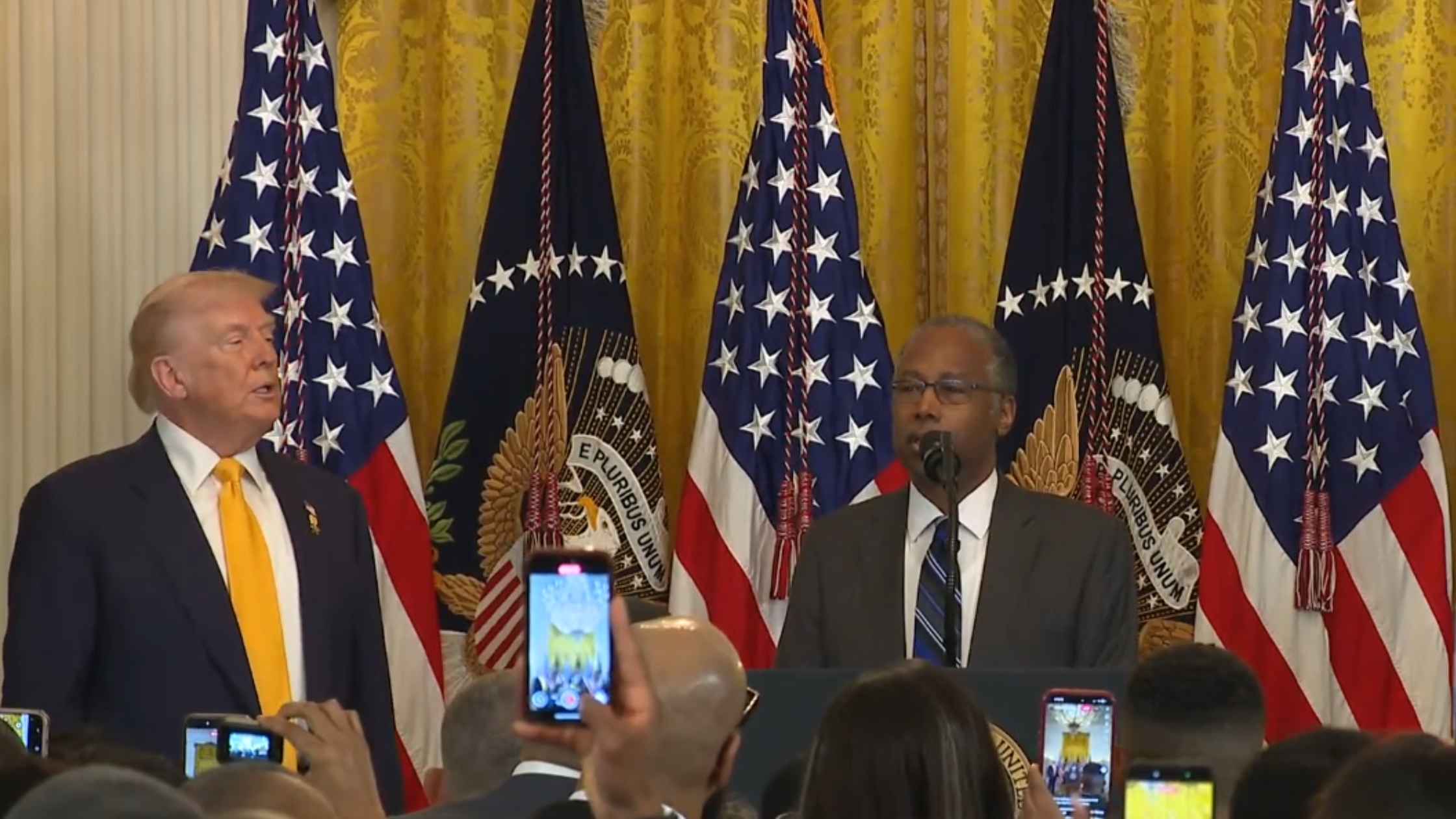

White House Black History Month Event

The White House holds an event to honor the 100th anniversary of Black History Month. Read the transcript here.

Family of Jesse Jackson Press Conference

The family of the late civil rights leader Reverend Jesse Jackson holds a news conference in Chicago. Read the transcript here.

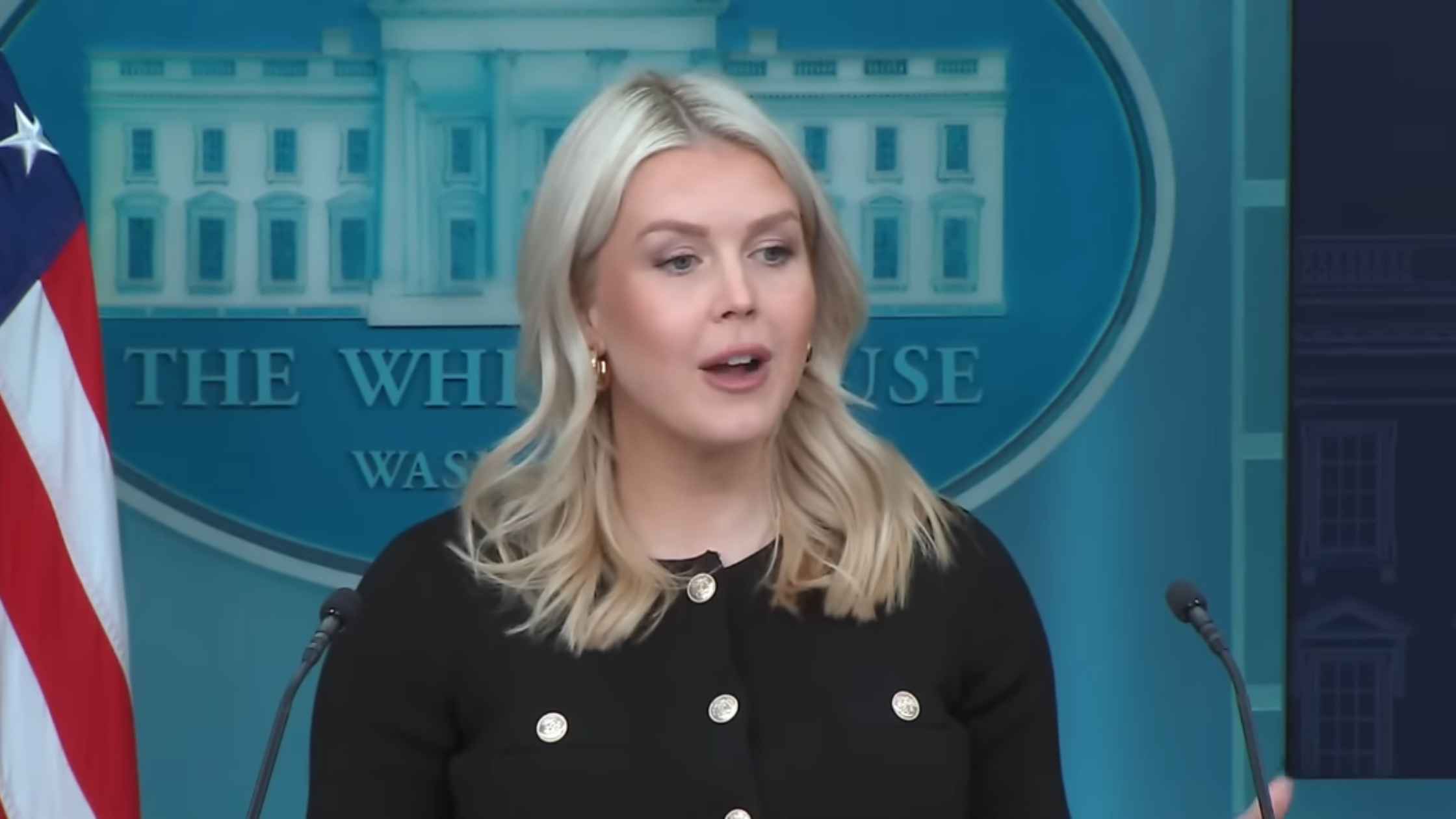

Karoline Leavitt White House Press Briefing on 2/18/26

Karoline Leavitt holds the White House Press Briefing for 2/18/26. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.