Rev’s Transcript Library

Explore our extensive collection of free transcripts from political figures and public events. Journalists, students, researchers, and the general public can explore transcripts of speeches, debates, congressional hearings, press conferences, interviews, podcasts, and more.

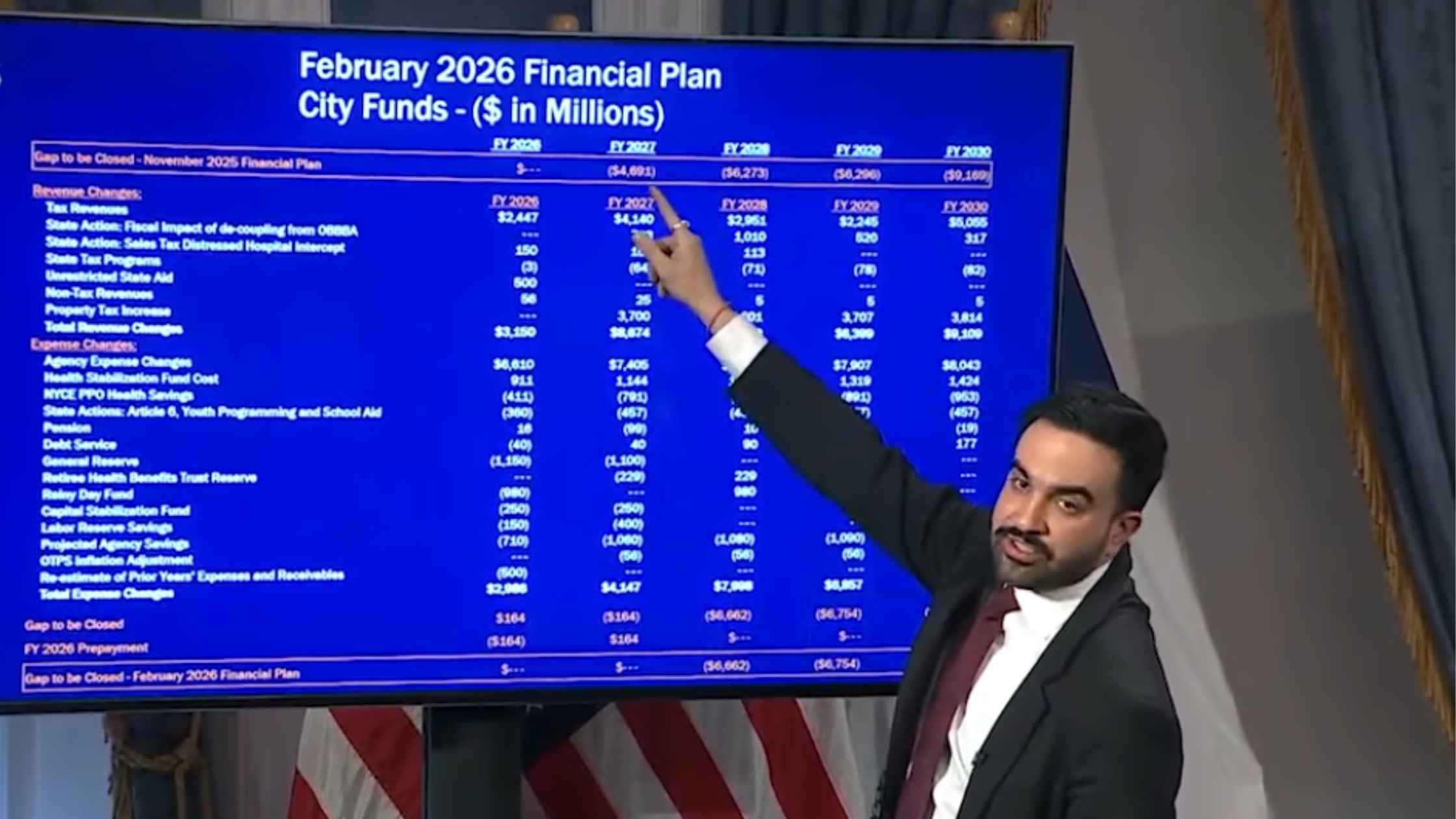

NYC Preliminary Fiscal Year 2027 Budget

New York City Mayor Zohran Mamdani holds a press briefing to unveil the preliminary fiscal year 2027 budget for the city. Read the transcript here.

Armed Suspect Arrested at Capitol

USCP Chief Michael Sullivan briefs the press after officers arrest an 18-year-old suspect with a loaded shotgun near the Capitol. Read the transcript here.

DeSantis Holds Workforce Education Briefing

Ron DeSantis holds a press briefing to celebrate Florida ranking #1 in workforce education. Read the transcript here.

Al Sharpton Eulogizes Jesse Jackson

The Reverend Al Sharpton holds a press conference after the announcement of Reverend Jesse Jackson's death. Read the transcript here.

Graham Press Conference in Israel

U.S. Senator Lindsey Graham holds a news conference in Tel Aviv after meeting with Israeli Officials. Read the transcript here.

Orban and Rubio Press Conference

Viktor Orbán and Marco Rubio deliver joint remarks in Budapest after the U.S.–Hungary civil nuclear pact signing. Read the transcript here.

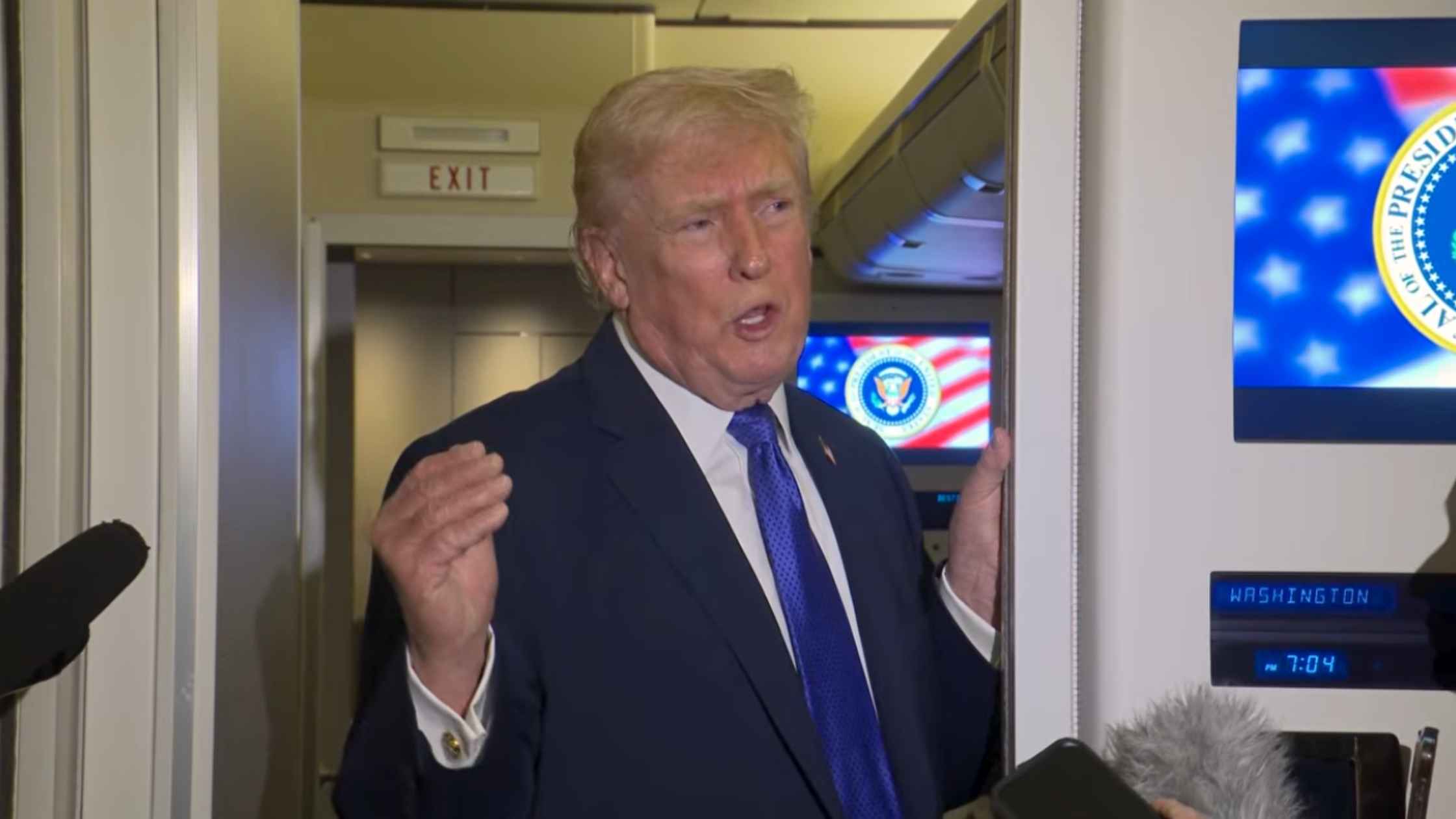

Air Force One Press Gaggle 2/16/26

Donald Trump gaggles with the press on Air Force One en route to Joint Base Andrews on Feb. 16, 2026. Read the transcript here.

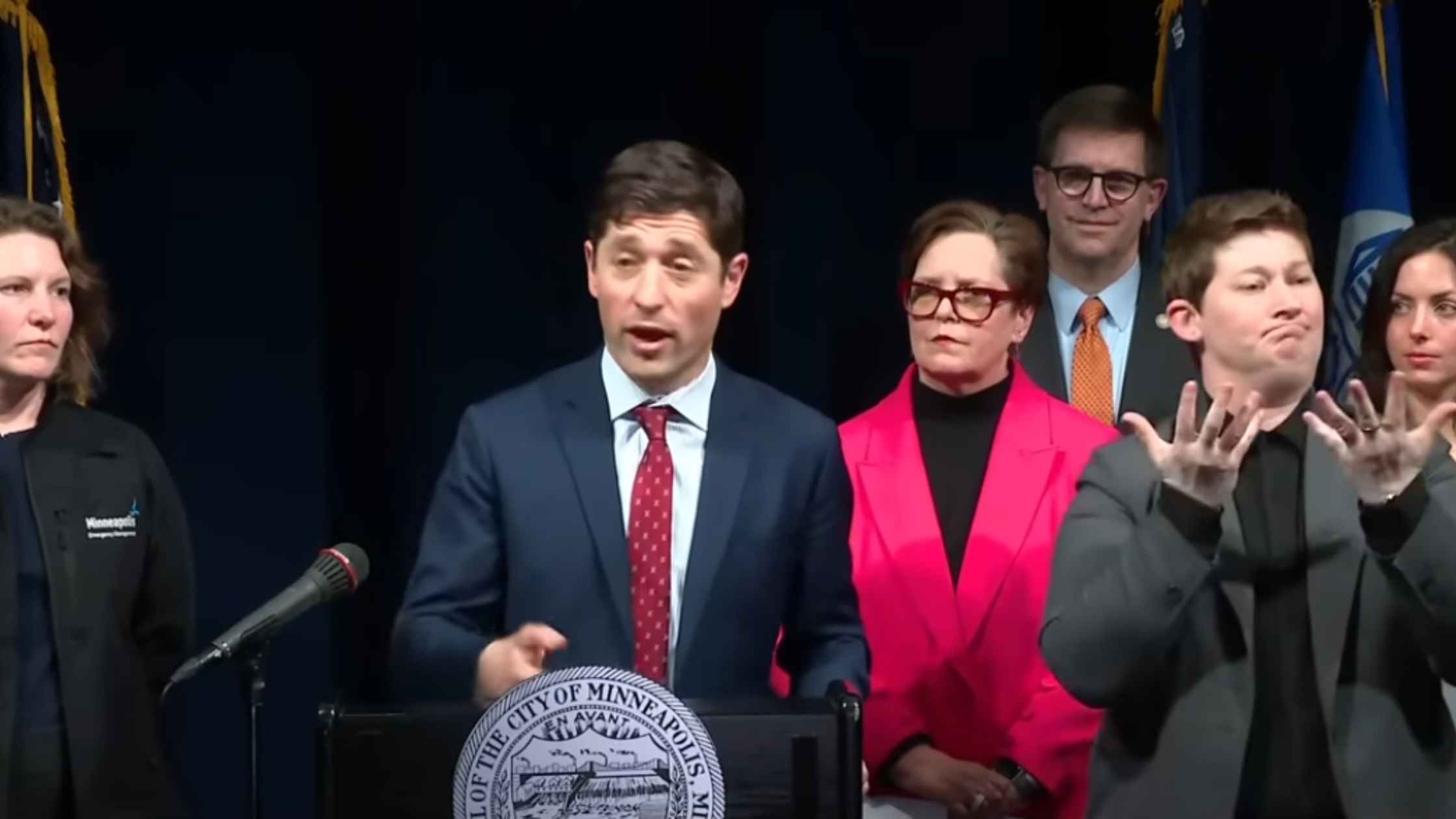

Minneapolis Mayor on ICE Drawdown

Minneapolis Mayor Jacob Frey addresses the end of Operation Metro Surge. Read the transcript here.

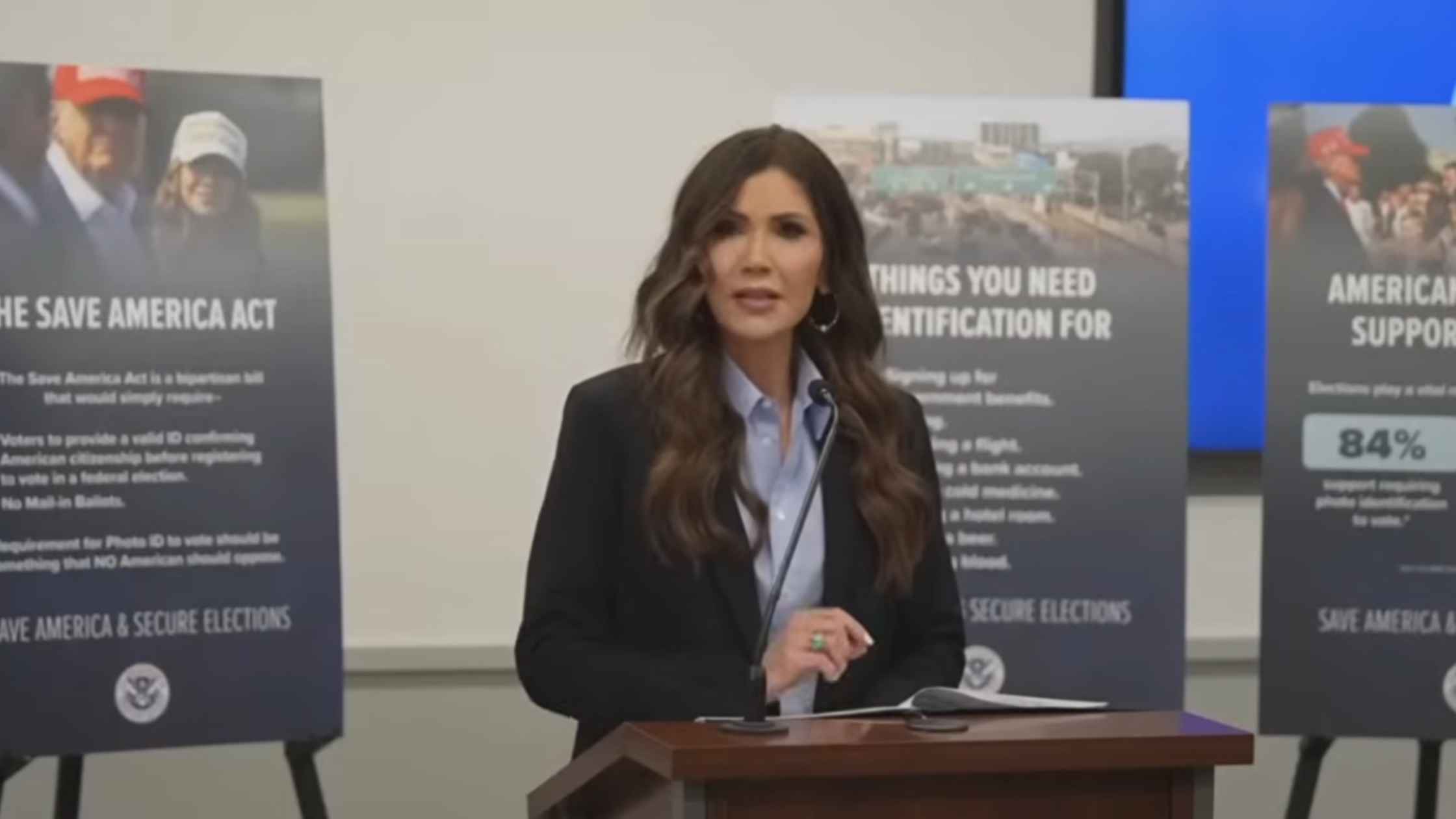

Noem on Elections

DHS Secretary Kristi Noem holds a news conference on election security ahead of the 2026 midterms. Read the transcript here.

Subscribe to The Rev Blog

Sign up to get Rev content delivered straight to your inbox.